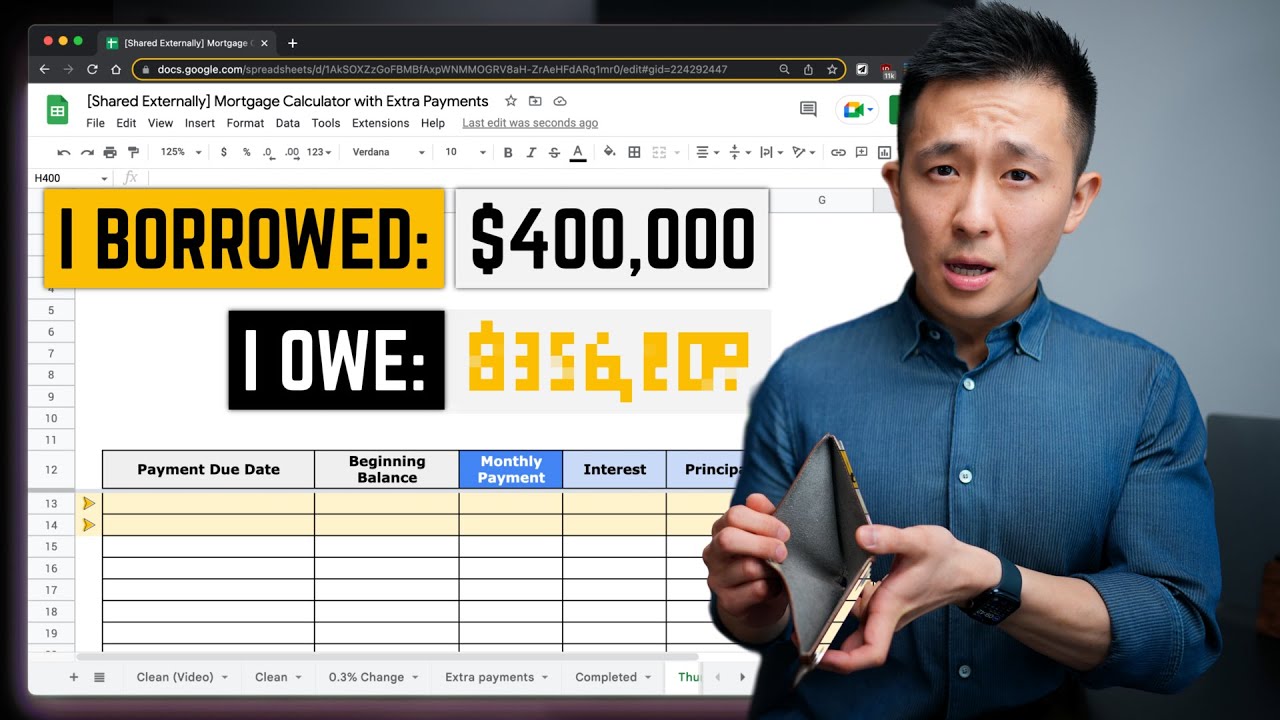

When diving into the mortgage scene, loan calc tools stand out as essential resources that can guide both first-time buyers and seasoned homeowners through financial waters. Understanding how to leverage these calculators can be a real money-saver, especially as property values fluctuate and lending trends shift. Whether you’re eyeing a spacious home in the suburbs or looking to invest in a rental property, applying these hidden gems could mean keeping thousands of dollars in your pocket. Let’s uncover the top seven secrets from loan calc that could significantly boost your savings by 2026.

Top 7 Secrets from Loan Calc That Could Save You Money in 2026

1. Understanding Loan Calc Variations: TX by TX

Mortgage calculators can greatly differ depending on local laws and regulations. For instance, in Texas (TX), homebuyers must consider specific loan calc parameters that account for state property taxes and insurance costs. A quick check on the local tax rate could reveal that you might end up paying less than expected. Always remember: knowing the tax laws can lead to a more accurate loan calc, allowing you to forecast your payments effectively and snag the best deal possible.

2. Using RDFN for Real-Time Market Data

Using Redfin (RDFN) isn’t just for browsing listings; it’s a powerful tool for accessing real-time market data. Tap into current trends to adjust your loan calculation inputs by learning about appreciation rates in your desired neighborhood. If, for example, prices in your area show an upward trend, you may want to re-evaluate your expected payments versus the potential value of the property. Riding the wave of market data can help you make savvy decisions, ensuring you’re prepared for your future financial landscape.

3. FFINS: Hidden Fees and Charges

Often overlooked in loan calc assessments are the financing fees, or FFIN. Origination fees, closing costs, and other charges can significantly inflate your final loan amount. For instance, negotiating with your lender on a $5,000 origination fee could save you a hefty chunk in upfront costs. Don’t shy away from these discussions; being proactive about hidden fees allows for strategic budgeting, making your overall loan less burdensome.

4. FNMA: Leveraging Government-Backed Loans

Understanding government-backed loans like those from the Federal National Mortgage Association (FNMA) can bring untold benefits. For instance, FHA loans offer low down payment options, making homes accessible for buyers with limited savings. This could mean that instead of needing a hefty down payment, you might only need 3.5% or less, drastically lowering your upfront costs and monthly payments. Don’t sleep on these options—factor them into your loan calculations to grasp the true scope of your financial commitments. If you want to explore FHA options, check out our detailed guide on FHA loans here.

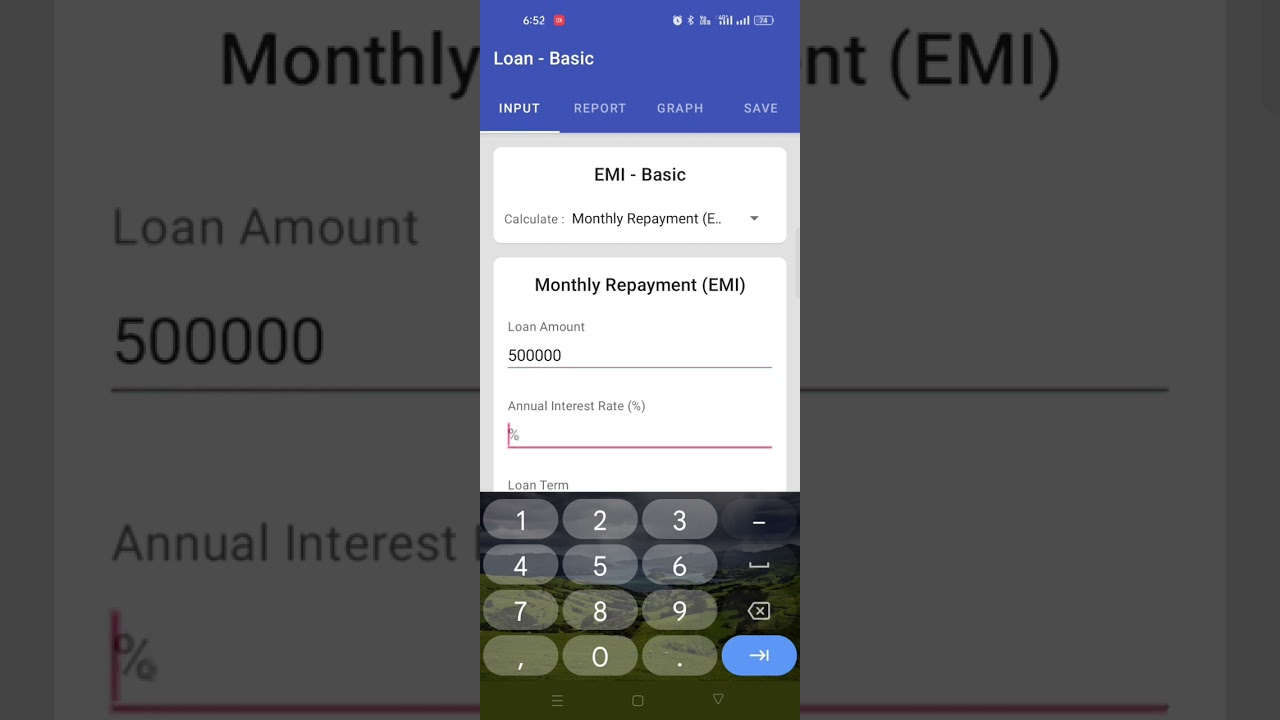

5. The Importance of Loan Types: LN0 vs. LN1

Understanding various loan types can change your financial outlook. LN0 loans, or no down payment loans, are great for younger buyers or those without substantial savings. On the flip side, LN1 loans, which require only a 1% down payment, can free up cash for other expenses like moving costs. Choose wisely between LN0 and LN1; your choice can dictate both your financial flexibility and your loan calc results.

6. Calculating Payments with WEC (WVEc) Adjustment

To improve your loan calc accuracy, incorporate the WVEc formula. This adjustment accounts for potential increases in property taxes and insurance costs, ensuring you don’t face future budgeting surprises. For instance, if you anticipate a 5% increase in property taxes, adjusting your loan calc accordingly can set realistic payment estimates. Being proactive helps safeguard your financial future against unexpected bumps in the road.

7. MLSLI Listings to Determine Neighborhood Trends

Using MLSLI (Multiple Listing Service Long Island) helps unveil neighborhood dynamics, such as average property values and trending prices that can influence your loan calculations. If you see an upward trend in home prices in areas like Nags Head, it may be wise to factor that into your loan assessments, helping you understand potential refinancing opportunities down the road. By staying informed about neighborhood conditions, you can set realistic expectations regarding your home’s future value.

Crafting Your Loan Strategy: How to Maximize Savings

Maximizing savings via loan calculators isn’t just about simple arithmetic; it’s about identifying elements that significantly sway your financial future. Work with a mortgage advisor who can help decode the specifics, elevating your investment strategy. Understanding state taxes, fees, and local trends enables you to unleash the full power of your loan calc, transforming your savings outlook.

As the real estate landscape shifts, keeping yourself educated and making strategic adjustments can be your secret weapon. With savings on the line, the time to embrace these strategies is now. By integrating real-time tools and market data, you’ll not only feel confident in your choices but may also stumble upon unexpected ways to save. So, roll up your sleeves and dive into the rich world of mortgage planning; the thousands you unlock could be life-changing!

Armed with these insights, you’re ready to take on your home-buying journey. Give yourself the gift of knowledge and step confidently into your future!

Loan Calc: Fun Trivia and Interesting Facts

Did You Know?

When diving into the world of loan calc tools, you’re not just looking at numbers; you’re stepping into a realm filled with fascinating facts. For instance, did you know that Richard Goodall, a talented singer, made waves in 2025’s AGT? His journey shows that sometimes, it takes a leap of faith—just like when you’re deciding on that perfect mortgage option. Speaking of decisions, understanding how loan calculus can work for you can really save you big bucks in the long run. It’s all about crunching those digits to find out what suits your budget best!

Historic Loan Tales

Let’s sprinkle in a bit of history. Before the advent of sophisticated loan calc tools, many relied on pen and paper to navigate the financial landscape. In fact, iconic brands like Lord and Taylor thrived by helping customers find the best deals; similarly, a reliable loan calculator can work wonders for your wallet. The key is to be informed, much like Carys Zeta douglas, who has constantly followed in her family’s footsteps while making her own mark. Just as she balances influences from both her parents and the entertainment world, you can balance your loan options with savvy calculations.

Pop Culture and Loans

If you’re a fan of quirky trivia, here’s a fun twist: Jane Asher, a British actress, once mentioned how important it is to educate yourself about finances. And while we’re at it, have you checked out that foxy one piece fashion trend? It’s not just about style; similarly, choosing the right loan options is all about making a statement with your finances. Whether you hone in on fixed or adjustable rates, the numbers can tell a compelling story, guiding you toward your dream home. With refined loan calc techniques, you’ll be ready to break out of the financial rat race and embark on that exciting home-buying journey!