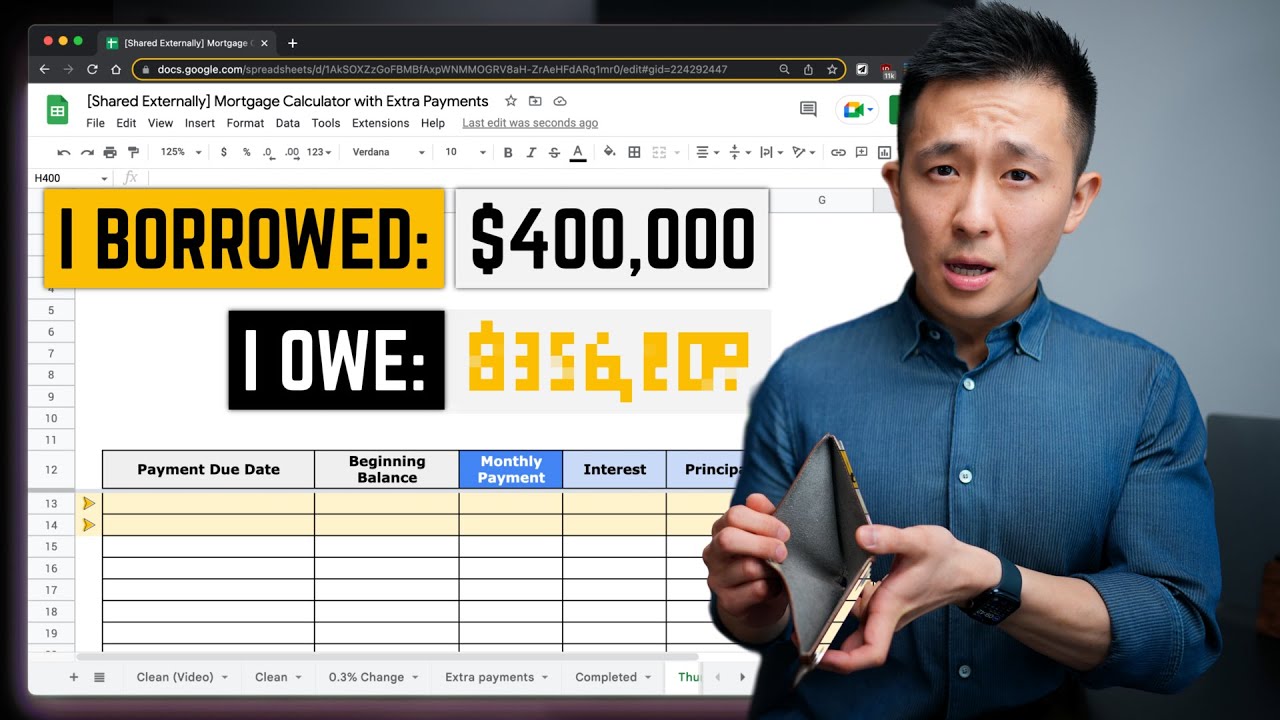

In today’s digital world, finding the right mortgage has become a vital step for first-time homebuyers and experienced investors alike. Thanks to tools like Mortgage Calculator Google, which allows users to estimate potential mortgage payments swiftly and simply, navigating the buying process is easier than ever. This article dives into how to leverage Google’s mortgage calculators to help make informed decisions, especially for markets in California, Florida, and Texas.

The Top 7 Google Mortgage Calculators You Should Know

1. Mortgage Calculator Google

Just type “mortgage calculator” into the Google search bar, and bam! You’ll immediately see their built-in calculator. This tool is incredibly user-friendly, letting you input loan amounts, interest rates, and loan terms to generate a monthly payment estimate. It’s perfect for quick calculations when you want to see if you’re close to affording that dream home.

2. Mortgage Calculator California

With California’s notoriously steep housing market, this specialized calculator is a lifesaver. It helps buyers consider local property taxes and housing insurance rates. In a market where affordability can seem out of reach, knowing your total monthly payment can keep your budget in check and help you avoid heartbreaking missteps.

3. Google Mortgage Calculator

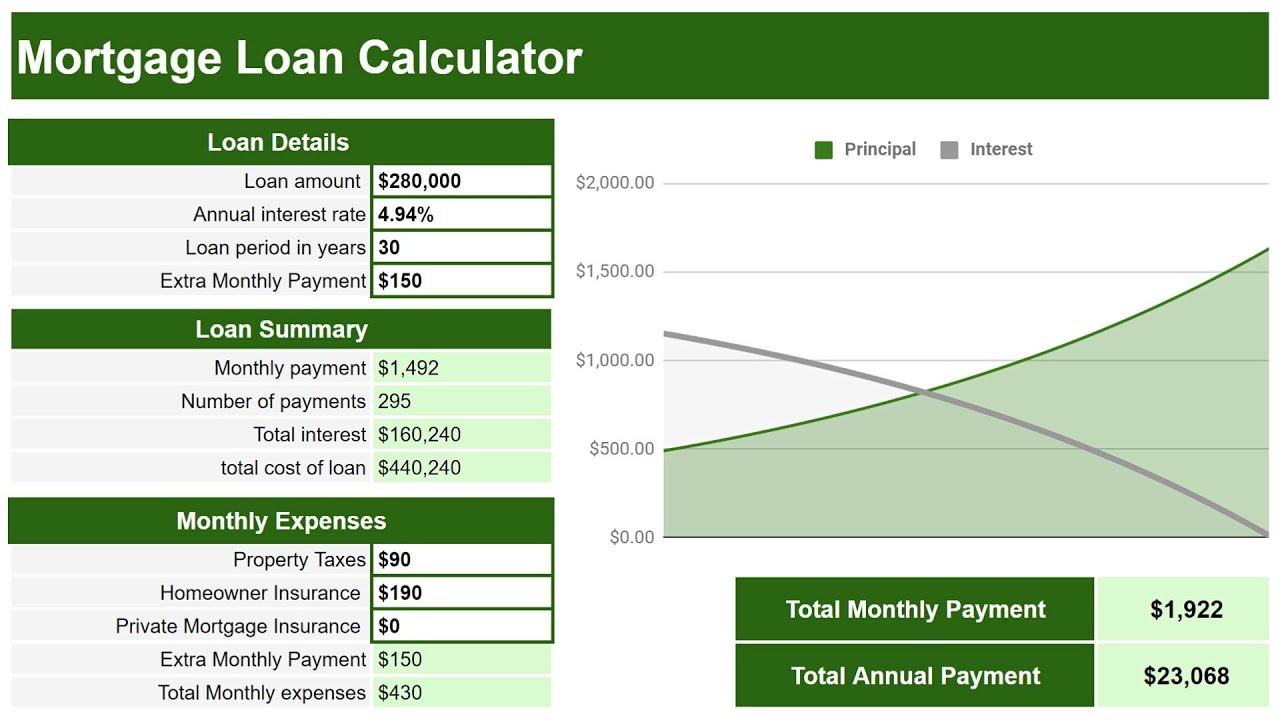

The Google Mortgage Calculator offers more than just monthly payment estimates. It allows users to factor in Private Mortgage Insurance (PMI) and closing costs, which is especially handy for buyers exploring various financing options based on the diverse regulations in different states.

4. Mortgage Calculator Florida

For Florida’s sunny citizens, having tools tailored to the unique market conditions is crucial. This mortgage calculator includes Florida-specific property taxes and even potential flood insurance, offering a more rounded view of what homeownership will truly cost. Don’t overlook hidden costs; these calculators help illuminate them.

5. Mortgage Calculator Texas

Texas homeowners can greatly benefit from calculators that account for the state’s specific tax structures and market trends. Such a calculator helps prospective buyers gauge affordability based on entered income, debts, and living expenses, making it easier to choose between bustling cities like Austin or Dallas without stress.

6. Cash Out Refinance Calculator

Thinking about tapping into your home’s equity? The Cash Out Refinance Calculator from Google lets existing homeowners see how much cash they can access through refinancing. Just enter the current home value and remaining mortgage balance, and voilà! You can evaluate your options and decide what makes the most sense financially.

7. Home Affordability Calculator

The Home Affordability Calculator allows you to assess your income and recurring debts to see what you can afford. By factoring in variables like property taxes and insurance costs, this tool gives you a clearer picture of your purchasing power, ensuring you’re ready for the financial commitments that come with homeownership.

Understanding Your Mortgage Options: Analysis and Insights

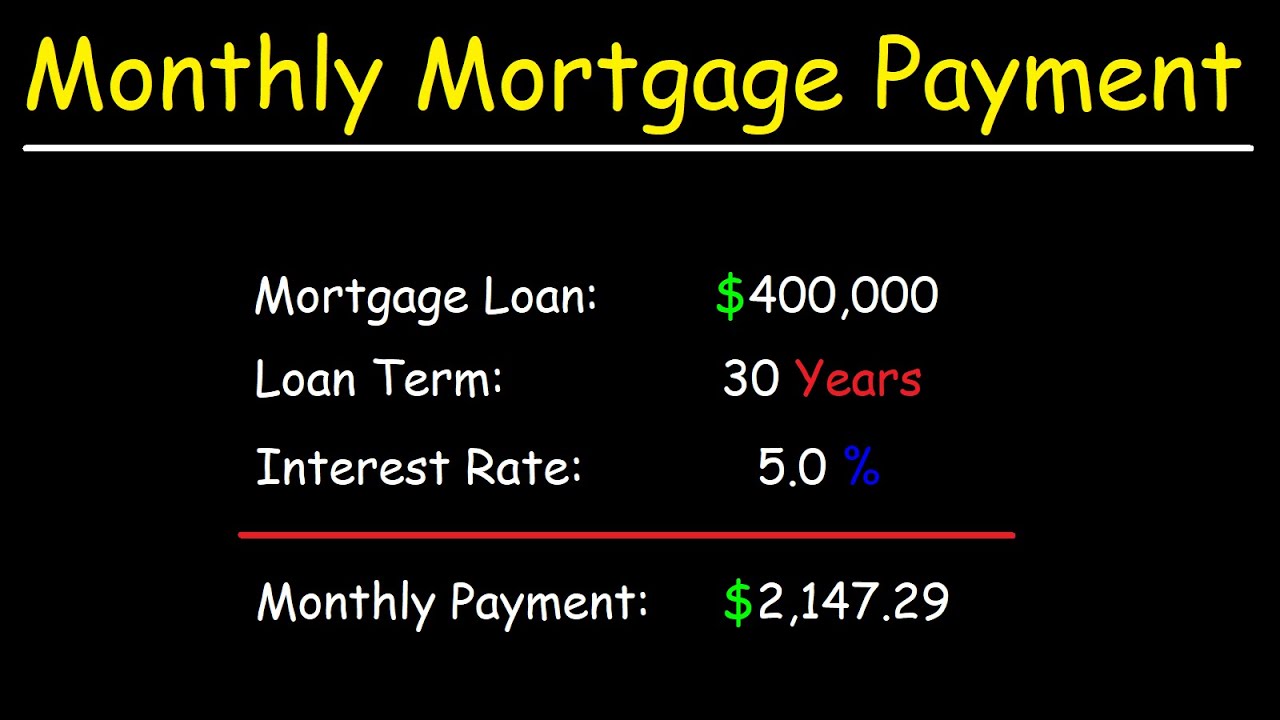

Using Google’s suite of mortgage calculators encourages a more nuanced approach to purchasing property. While these calculators provide estimates, grasping key components like loan structures and interest rates is crucial. For instance, a 30-year fixed-rate mortgage is often a favorite due to its stability, but in areas with rapid property value changes—like California or Florida—an adjustable-rate mortgage (ARM) might be more appealing.

As we analyze trends in 2026, fluctuating mortgage rates create unique challenges for buyers. Inflation impacts housing affordability, making it essential to understand how rate changes can affect your mortgage payments. A small uptick in rates may dramatically alter your monthly financial obligations, emphasizing the need for careful planning around your finances.

Evaluating Your Budget: The House Payment Calculator

A thorough house payment calculator goes beyond just a number; it incorporates property taxes, PMI, homeowners’ insurance, and even HOA fees to give you a complete picture of your financial responsibilities. For example, the Zillow mortgage calculator is an excellent tool for comparing similar properties and quickly checking whether a specific house fits within your budget set by the Google mortgage calculator.

If you’re a first-time buyer who prefers straightforward answers, a simple mortgage calculator can serve you well, focusing on primary numbers without getting bogged down in extra complexities. On the other hand, seasoned buyers often favor detailed options that provide breakdowns of monthly versus bi-weekly payments, along with the total interest over the life of the loan.

Making the Smart Move

The various mortgage calculators available through Google empower homebuyers to make informed decisions tailored to their financial situations and regional conditions. By thoughtfully utilizing these tools, buyers can streamline their purchasing processes while ensuring their strategies align with long-term financial goals.

Navigating the competitive real estate market of 2026 will be easier when you understand how to leverage Google’s mortgage calculator suite effectively. So, take command of your home-buying journey—don’t be afraid to crunch some numbers, especially when considering big purchases, like a new coach heart bag or planning a weekend getaway at the Sea Ranch lodge. The keys to a successful home purchase are just a few clicks away!

Mortgage Calculator Google: Your Smart Home Buying Guide

The Power of Mortgage Calculator Google

Did you know that the mortgage calculator google is more than a simple tool? It’s a smart companion that can save you thousands over the life of your loan. By inputting numbers like your home price, down payment, and interest rate, you can get a quick snapshot of what you might pay monthly. It’s almost like having a personal finance assistant right in your pocket! Plus, just like using a net pay calculator, it cuts through the confusion and gives you a clear idea of what fits your budget.

Fun Mortgage Calculator Facts

Here’s a fun tidbit: many first-time homebuyers overlook the power of this tool! Just imagine figuring out your mortgage payments in a flash—no need to stress over complicated formulas or lender jargon. With just a few clicks, it feels like you’re dealing with a magic crystal ball, letting you peek into your financial future while considering options between places like Amherst MA or Hudson MA. After all, you wouldn’t buy an expensive car without checking out a car loan calculator google, so why treat your home purchase any differently?

A Little Extra: Beyond the Basics

And here’s something that might surprise you: using the mortgage calculator google often leads to better financial decisions. Many savvy buyers get creative by testing different scenarios; for example, they might adjust their down payment or explore various interest rates. It’s like planning a movie night! Just as you’d weigh options between Eskimo and Encore flicks, you can compare mortgage payments and find your perfect financial fit. So, next time you’re house hunting, remember that this tool might just be the best trick up your sleeve!