Dreaming of that perfect home? You’re not alone! But understanding how much is a dream home worth in today’s market can be a real head-scratcher. With the unpredictable changes in real estate prices, mortgage rates, and buyer preferences, the worth of your dream home in 2026 requires a comprehensive view from various angles. Let’s unravel these complexities together, so you can make an informed, confident decision.

Understanding how much is a Dream Home Worth in 2026

The worth of your dream home depends heavily on multiple facets—location, current mortgage rates, and property types, to name a few. In 2026, many buyers face affordability challenges resulting from market fluctuations that followed the pandemic. This means that analyzing these essential factors is key to gauging your dream home’s value.

In this era, data-driven insights play a critical role. For instance, if you’re looking at popular cities like Austin, Texas, you’re stepping into a hotbed of rising property values. A home that may have cost you $400,000 just a few years ago could now be worth over half a million based on location and market trends.

So how do you determine worth? That’s where examining the nuances of the real estate landscape comes into play, ensuring that you’re not left guessing how much is a dream home truly valued at in this current climate.

Top 7 Factors Affecting how much is a Dream Home Worth

When figuring out the valuation of your dream home, keep an eye on these essential factors:

It’s an old adage, but it still rings true! Properties in bustling areas like Austin and Miami are seeing serious boosts in value, driven by job opportunities and the migration of new residents seeking vibrant communities. For example, home prices in Austin have surged more than 25% since 2020, largely thanks to the tech industry’s rapid growth.

In 2026, mortgage rates hover between 4.5% and 6.5%. This fluctuation plays a significant role in what buyers can afford. Lower rates often mean buyers will shell out more for their dream homes. Therefore, jumping on favorable loan options could be the ticket to unlocking your ideal space.

If you’re eyeing homes inside planned communities or condos, understanding Homeowners Association (HOA) fees is crucial. These fees can range anywhere from $200 to $600 monthly in urban settings. They can dramatically influence your total ownership costs. Condos may be tempting for first-time buyers, but don’t overlook the added expense of HOA fees.

Condominiums often offer a more budget-friendly entry into desirable neighborhoods. Prices typically range between $250,000 to $750,000 in cities like San Diego. Knowing the differences in valuation between condos and single-family homes helps clarify the marketplace and could lead you to your dream setup.

It’s vital to understand what similar homes in your desired area have sold for recently. In 2026, suburban areas show remarkable appreciation. For example, homes that were selling for $500,000 a few years back have jumped to around $650,000. This change reflects shifts in buyer preferences towards spacious homes with yards as more people opt for suburban living.

A newer build tends to hold greater value due to contemporary features and lower maintenance needs. A home constructed in 2022 might list for around $750,000 in Denver, while a fixer-upper from the 1980s could be priced at $450,000 yet require a renovation budget of another $100,000. Understanding these distinctions is pivotal in knowing how much is a dream home worth.

Economic indicators, particularly consumer confidence and employment rates, influence buyer enthusiasm. The economy’s upswing in 2026 leads to boosted buyer sentiment, resulting in competitive bidding and inflated home prices. Monitoring economic trends helps gauge how much your dream home could potentially rise in value.

What’s the Future of Dream Home Valuations?

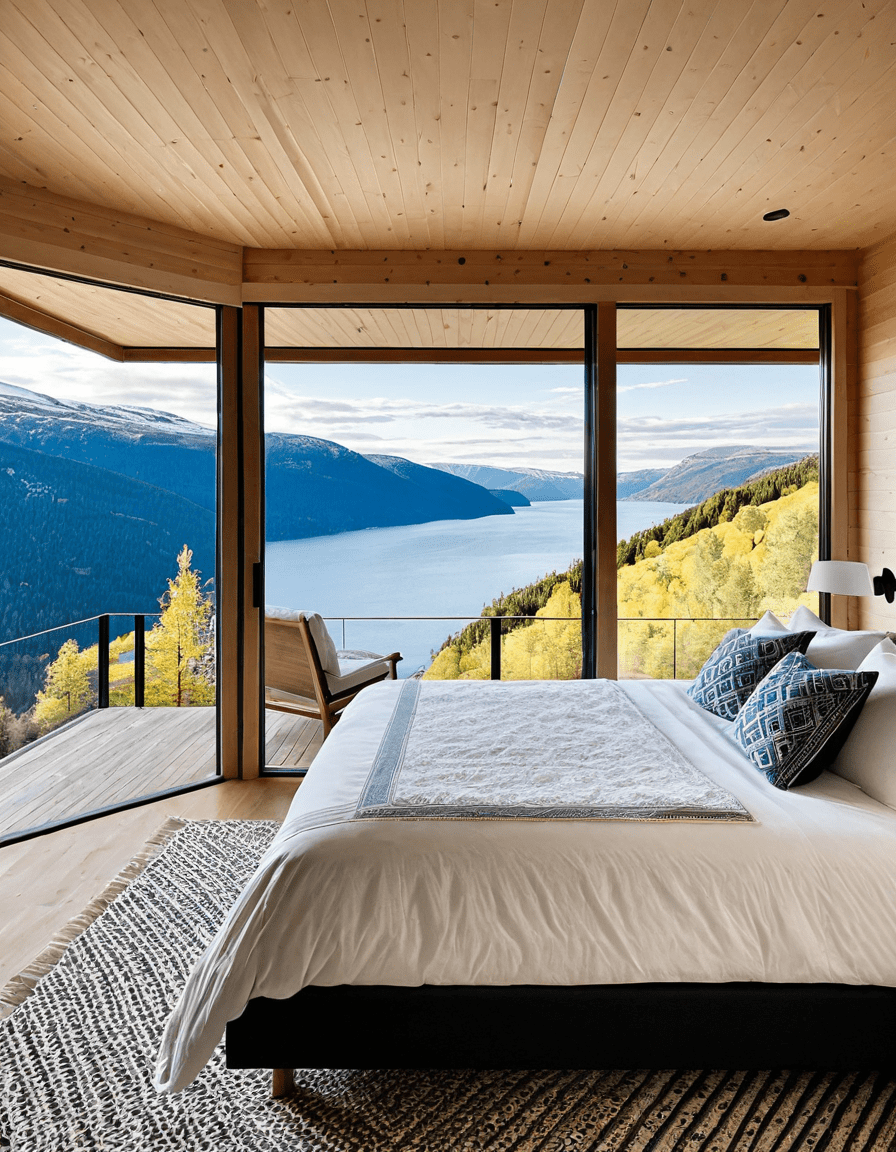

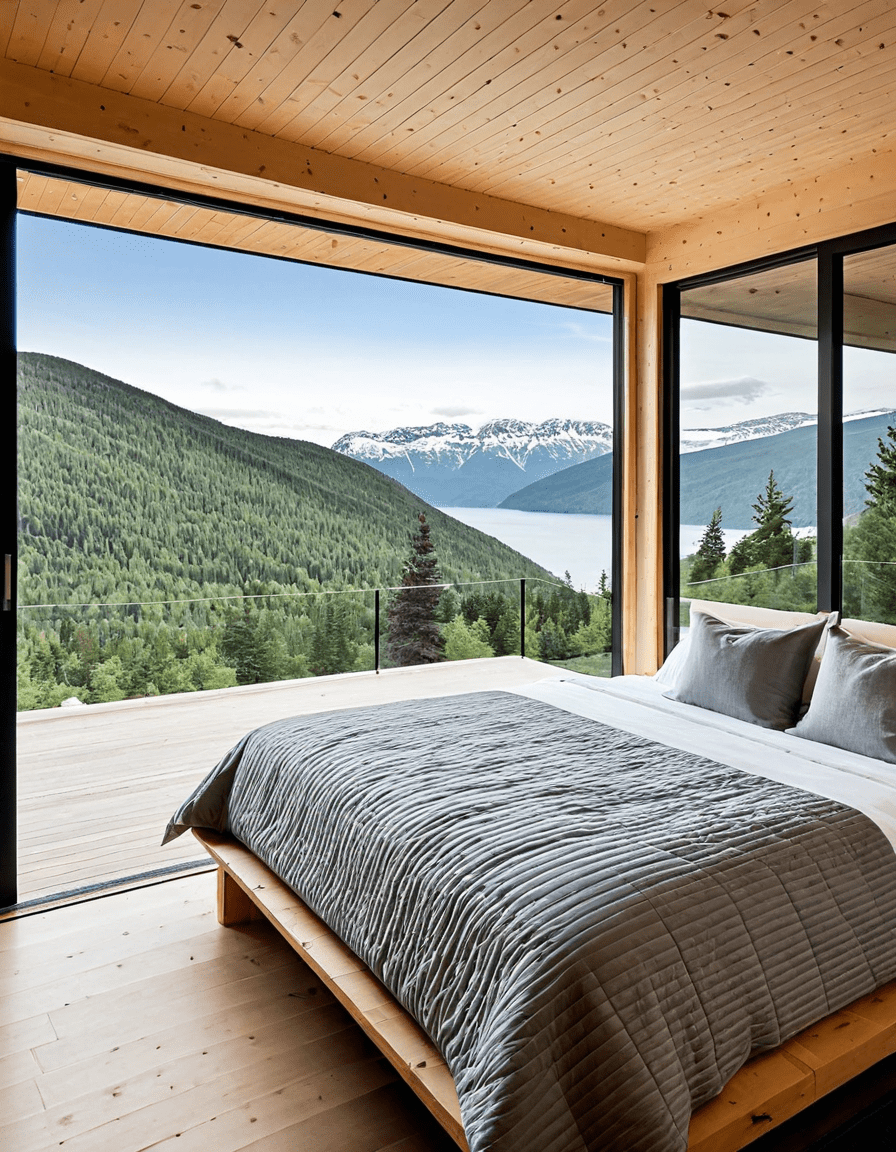

As we delve deeper into 2026 and beyond, keep an eye on the evolving dynamics of the real estate market. Emerging trends such as smart home technology and sustainable building methods can increase a property’s value. For buyers, knowing these trends can be instrumental to their investment strategy.

Stay abreast of economic forecasts too! Realizing how overarching financial trends can affect housing prices will better prepare you to make savvy decisions. As these trends unfold, your understanding will empower you to confidently approach your dream home search.

Final Thoughts on Valuing Your Dream Home

Valuing your dream home in 2026 isn’t a one-size-fits-all endeavor. By paying attention to myriad factors—such as location, mortgage rates, HOA fees, property types, and market shifts—you’ll equip yourself with the knowledge to accurately assess what’s on the table.

Remember, staying informed and adaptable is key. When opportunities knock in today’s competitive market, you’ll be ready to seize them! As you journey towards homeownership, allow the insights shared here to guide you every step of the way.

If you’re seeking more information on mortgage details or understanding what is a lien, you can check out our comprehensive resources. Happy house hunting, and may you find your dream home soon!

Incorporate useful links within your research:

how much is a Dream Home Worth in Today’s Market

The Price Tag That Comes with Dreams

When pondering “how much is a” dream home worth, you might be surprised by how much regional differences affect pricing. In some parts of the U.S., the average home price can soar way above $500,000, while other areas might offer charming properties for under $200,000. For first-time buyers, this disparity can feel overwhelming. It’s worth noting that the current real estate market tends to sway with economic factors, and thus keeping an eye on mortgage rates can be quite beneficial. Curious to know how your current financial situation stacks up against the competition? A recent study reveals that savvy buyers who get pre-approved for a mortgage often have better chances of snagging their dream homes in tight markets.

The History Behind Home Valuations

So, how much is a dream home worth today, really? Interestingly, home prices have nearly doubled over the past decade in many cities. Back in the early 2000s, you could score a house for a fraction of the price, which sparks nostalgia for seasoned homeowners remembering those days. Also, did you know that certain home features—like energy efficiency or smart home technology—can significantly bump up your property’s value? Homes today aren’t just selling for square footage; they’re competing on tech-savvy features that appeal to modern buyers. If you’re curious about how extras can factor into your home’s worth, diving into the latest home improvement trends might reveal clever upgrades that pack a punch for resale.

Understanding the Current Market Dynamics

If you’re still wondering “how much is a” dream home priced to sell in 2023, you should consider market fluctuations in a timeline perspective. Economic indicators like the job market, interest rates, and even social trends can play a key role in determining housing costs. Did you know that the impact of remote work has led many families to move away from city centers, driving suburban home prices up? And speaking of shifts, homes near good schools have consistently shown higher resale values, proving that sometimes, location truly is everything. With all these factors in play, understanding your local real estate market becomes essential—it could be the difference between snagging an affordable gem or overpaying. So, get ready to pay attention, because every bit of knowledge helps clarify how much is a dream home worth in today’s market.