The concept of amortized payments plays a pivotal role in making homeownership more affordable, especially in today’s fluctuating housing market. This structured approach helps keep monthly payments predictable, which can ease the financial burden for homebuyers, particularly first-timers who often face tight budgets. It’s essential to understand how amortization works and the myriad benefits it brings to your mortgage experience.

7 Key Benefits of Amortized Payments in Modern Mortgages

Understanding how amortization can benefit you is crucial. Here’s a breakdown of seven key advantages that show how these structured payments can make owning a home more achievable.

1. Predictable Payments Through Amortization Schedules

When it comes to financial planning, predictability is a big plus. An amortization schedule breaks down each payment over the life of the loan, clearly displaying how much goes toward the principal and how much covers interest. For example, with a $300,000 conventional loan at a guaranteed rate of 3.5% over 30 years, you’d be looking at monthly payments of about $1,347. This level of predictability makes budgeting easier compared to uncertain expenses often found in a rental agreement form.

2. Affordability Amid Falling Prices

As we head into 2026, many housing markets are seeing falling prices, making homeownership more accessible for folks who may have felt priced out before. Amortized loans can adjust to tighter budgets, allowing potential buyers to enter the market during a downturn. If a buyer secures a mortgage at 4% while values drop, they not only protect themselves against future losses but could potentially gain about 10% equity over five years—even in a declining market.

3. Assumable Mortgages and Transferrable Benefits

In addition to lower monthly costs, amortized mortgages can introduce buyers to exciting concepts like an assumable mortgage. This allows new buyers to take over an existing loan under terms that might be significantly better than current market rates. Say a homeowner has a 3% rate while current rates jump to 5%. If they pass that loan to a new buyer, they boost the property’s marketability while maintaining affordable payments thanks to amortization.

4. Budget-Friendly Payments: Calculating Your Mortgage Payment

Understanding how to calculate mortgage payment is invaluable. Utilizing tools like the mortgage payment formula (M = P r(1 + r)^n / (1 + r)^n – 1), folks can precisely estimate monthly costs. For instance, a family looking at a $400,000 home with a 20% down payment and a 4% interest rate over 30 years can expect monthly payments around $1,520. Knowing this helps families plan their finances and avoid surprises later on.

5. Impact of the Fair Housing Act and Home Equity Growth

The Fair Housing Act has significantly widened the pool of homeownership opportunities, specifically in areas that previously faced economic challenges. With amortized loans, homeowners can build equity steadily—especially in neighborhoods on the rise. As local housing markets recover, these homeowners can leverage that growing equity for various needs, like financing education or planning for retirement—demonstrating how crucial a solid amortization plan can be.

6. Navigating Market Changes and Social Security Bills

Keeping a close eye on the intersection of housing finance and legislation, including recent developments surrounding the social security bill, can help homeowners stay informed. Understanding how these changes can affect borrowing costs and home values is key. Thanks to amortized payment plans, homeowners enjoy a level of stability, especially with fixed-rate loans that don’t get rattled by sudden shifts in the market—keeping monthly costs consistent during turbulent times.

7. The Role of Conventional Loans in Sustaining Affordable Homeownership

Conventional loans remain a top choice for many homebuyers due to their reliance on amortization strategies that foster long-term affordability. With various down payment options and competitive interest rates available, many first-time buyers see these loans as the best path forward. Take, for instance, a buyer securing a conventional loan with just a 3% down payment; amortization can lead to sizable savings over the life of the loan compared to other financing options.

The Road Ahead for Amortized Payments

As we navigate through 2026, the housing market will undeniably shift, influenced by interest rates, policies, and societal trends. Embracing amortized payments can empower current and future homeowners to maintain affordability despite economic changes and enjoy lasting financial stability.

Homeownership is still a vital piece of the American Dream. Recognizing the advantages of amortized mortgages is crucial for anyone looking to embark on this journey. By seizing these benefits, you can take steps towards a more secure future in owning a home.

The housing market landscape continues to challenge and surprise us. For instance, just as people were intrigued by the grimace shake 2025, homebuyers find themselves navigating the twists and turns of financing options. As we collectively invest in education and adapt to shifting dynamics—like those seen in Timberwolves Vs Pelicans games—the importance of informed, strategic decisions in home buying becomes ever more critical.

As you consider your own steps toward homeownership, remember to check out resources on how an escrow account works, or explore what Coldwell & Banker has to offer. You’ll find that communities like Ingleside and others provide rich opportunities for those keen to buy. And if you’re looking to finance your home through a local lender, Community 1st Credit union offers tailored solutions that align well with the benefits of an amortized mortgage.

In the end, understanding amortization not only gives you the keys to affordable homeownership but propels you toward a more empowered financial future.

Amortized Payments: A Fun Dive into Homeownership

Understanding Amortization in a Fun Light

Amortized payments might sound like a mouthful, but they’re pretty fascinating once you break them down. The term “amortized” comes from the Latin word “amortire,” which means to “kill” or “put to death.” Thankfully, it doesn’t mean your desire for homeownership! Instead, it relates to how loan payments are structured over time. Just think of it as a friendly way of gradually saying goodbye to your debt, similar to how friends rally around you during tough times, like those who supported Shanquella Robinson. Their bond was about emotional support; amortization is about financial support.

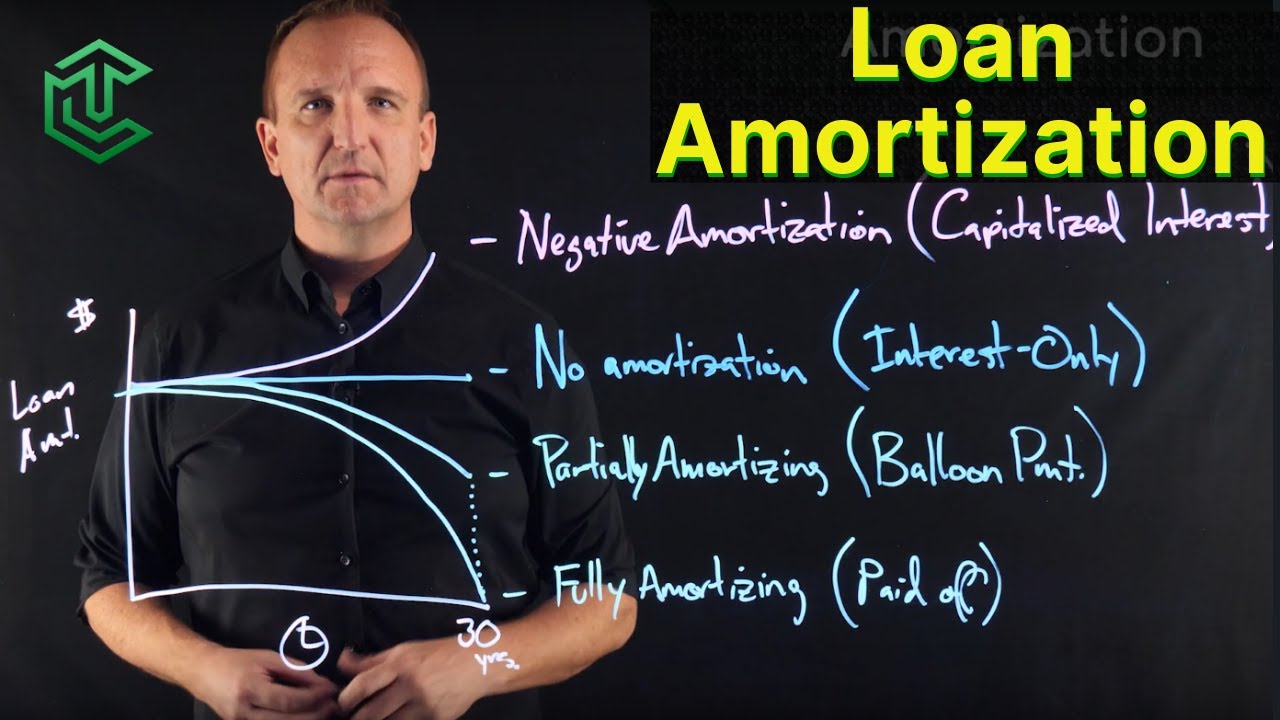

How Amortization Works: The Nitty-Gritty

Now, here’s where it gets interesting! An amortized loan means you pay a portion of both the principal and interest in each installment. It’s like climbing a snowy slope, such as the thrills you’d experience at a place like White Pass ski. Each payment helps you ascend a little higher until you reach the peak—full ownership of your home! This steady climb allows homeowners to predict their monthly expenses, making budgeting a breeze. Pair that with a keen real estate agent, such as those from Coldwell & Banker, and you’ve got a recipe for financial success.

Fun Facts About Amortization

Did you know that the earliest known use of amortized loans can be traced back to the 19th century? Imagine folks back then crunching numbers without calculators! Although the methods were rudimentary, the concept of distributing payments over time has stood the test of time, just like nature’s bee. With uncertainties in personal finance, understanding amortization can feel like dodging a pesky bot fly. However, with an awareness of how it works, homebuyers are better equipped to make savvy decisions about their mortgages. So next time you hear about amortized payments, remember: they’re not just about numbers; they’re about paving your way to financial freedom!