Buying or selling a home is a big deal, and appraisers play a crucial role in that process. They serve as unbiased third parties who assess a property’s value, making sure everyone pays or receives a fair price. By looking at factors like location, condition, and comparable sales in the neighborhood, they help ensure buyers and lenders don’t overpay. Understanding how appraisers work and their secrets can save you thousands of dollars. Let’s dive into what you need to know!

Understanding the Role of an appraiser in Real Estate Transactions

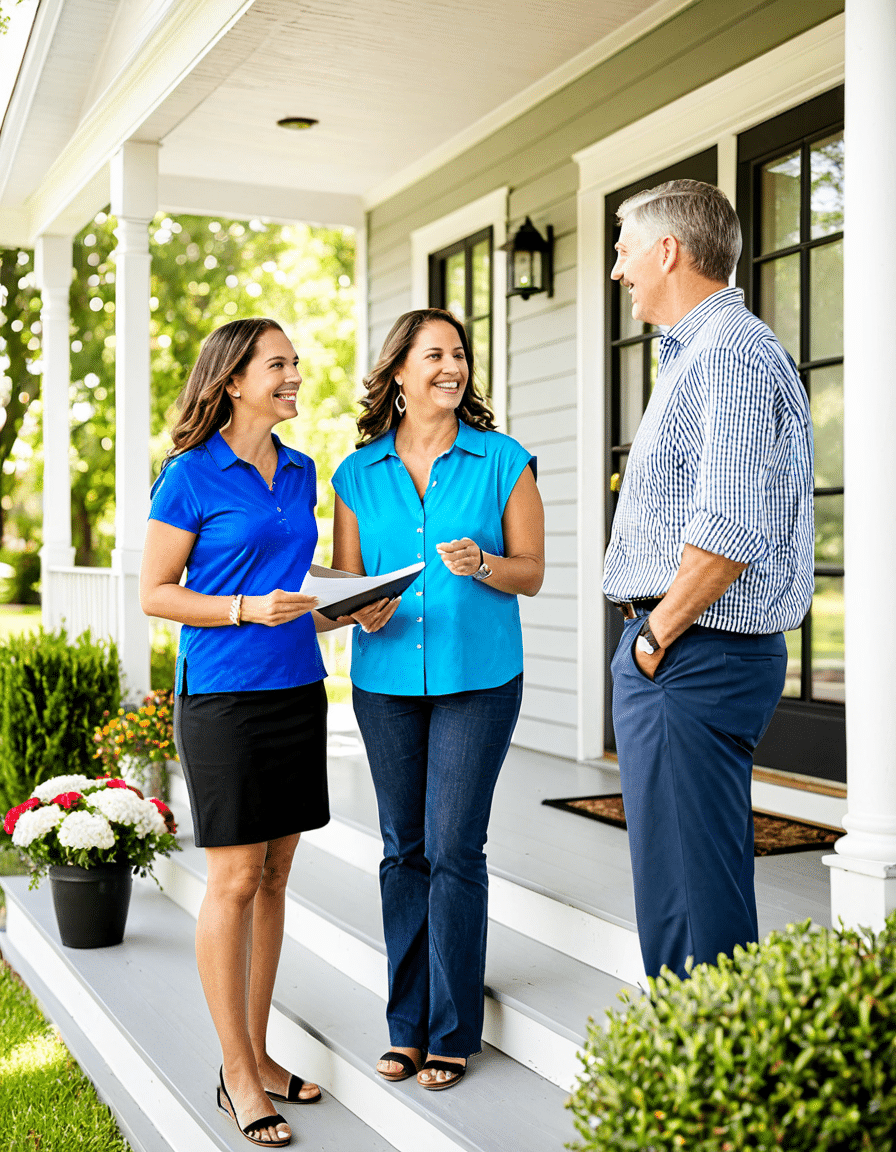

appraiser are essential players in real estate transactions. They provide valuable insights that contribute to fair pricing for properties. Without their expertise, buyers might unknowingly pay more than a home’s worth, and sellers could miss out on potential profits. A professional appraiser examines a variety of elements: the property’s condition, its location, and recent sales data from comparable homes nearby.

The appraisal process often determines whether a mortgage gets approved, directly impacting buyers’ ability to secure financing. When an appraiser comes on-site, they’ll take note of the home’s unique features, the neighborhood, and general market conditions. A well-done appraisal can give buyers confidence and help sellers set a competitive price.

Knowing how appraiser evaluate a property can make a significant difference when it comes to money. If you understand what they look for, you can take steps to improve your home’s marketability and appraisal value.

Top 7 Secrets appraiser Don’t Want You to Know

First impressions matter, and curb appeal can significantly influence your home’s appraised value. appraiser evaluate your home’s exterior, so small upgrades, like landscaping or a fresh coat of paint, can create a positive impact. For example, a study by HomeLight revealed that homes with attractive exteriors can receive appraisals as much as 15% higher than their poorly maintained counterparts.

Investing in simple projects, such as cleaning out the yard or sprucing up the front door, can set a positive tone. Everyone loves a charming exterior, and it can speak volumes to an appraiser right from the get-go.

Timing is everything in real estate, and understanding local market trends can be a game changer for your appraisal. For instance, as of 2023 in Austin, TX, the median home price hit $525,000. Being aware of these statistics helps you position your home better for appraisal.

Keep tabs on your local market trends and have solid data ready when discussing your property. Knowing the average home price and recent sales in your area can give appraiser a clearer picture, impacting your property’s valuation positively.

Not all renovations are created equal, and some can leave you with less return than you’d hope for. According to the 2023 Remodeling Impact Report by the National Association of Realtors, kitchen renovations typically recoup about 68% of costs during an appraisal.

Pick renovations wisely; invest in upgrades that are valuable to potential buyers. For example, adding a modern kitchen or enhancing bathrooms tends to yield better results than personal preferences like elaborate fountains.

Keeping a detailed record of all your home improvements can pay off significantly during an appraisal. When an appraiser evaluates your home, having documentation of upgrades—like a new roof or energy-efficient HVAC system—adds credibility.

For instance, if you’ve recently installed a top-of-the-line HVAC system, make sure to have the invoice and warranties ready. This documentation can enhance your home’s value, reassuring appraiser that you’ve invested in your property.

Choose your appraiser wisely. An appraiser with extensive knowledge of your local area is invaluable. If they’re from a town nearby, they may lack insight into your neighborhood, leading to inaccurate valuations.

A local appraiser knows market trends and comparable properties in your area. Take the time to ensure your appraiser has experience and knowledge specific to your locality.

Don’t overlook the fees involved in the appraisal process. As of 2023, the average appraisal cost hovers between $300 to $600, depending on your location and property type.

Some lenders, like Better.com, might roll appraisal costs into your closing fees, which can ease financial pressure upfront. Being aware of these hidden costs can potentially save you money in the long run.

Believe it or not, the financial stability of a borrower can influence appraisals. An appraiser might feel more confident assigning a higher value if they believe the borrower is solid financially. For example, a nurse anesthetist with a median annual salary of $195,000 can often give appraiser a reason to feel assured about the property in question.

A stronger borrower profile can enhance the appraisal process, making all parties feel confident about the transaction.

Innovative Strategies for Maximizing Your Appraisal

As the real estate landscape keeps evolving, your approach should change, too. Engaging actively with your appraiser by giving them a comprehensive overview of your home can only help. Open communication helps clarify any discrepancies during the evaluation and is vital for a smooth appraisal process.

Consider scheduling pre-appraisal consultations, working with a trusted real estate agent who can guide you on specific areas for improvement before the official appraisal. Being proactive can lay the groundwork for a more favorable appraisal result.

By understanding these appraiser insights, you have the chance to save thousands in the appraisal process. Knowing the ins and outs can empower you in the real estate market, helping you protect one of your most crucial investments. In the end, the appraisal won’t just be a formality; it can lead to significant savings that make all the difference in your buying or selling journey. Your home is a treasure, so maximizing its value is key.

In a nutshell, education and preparation can go a long way. Keep these tips in mind as you engage with your appraiser next time—you won’t regret it!

appraiser Insights: Fun Facts to Save You Thousands

The Art and Science of Appraising

Did you know that an appraiser’s job is much more than just slapping a number on a home? That’s right! These professionals combine market knowledge, property condition assessments, and neighborhood trends to determine a home’s value. In fact, the estimation process can sometimes rival the complexity of creating a best-selling anime like Fullmetal Alchemist—both require keen insight and a deep understanding of their subject matter. And here’s a quirky tidbit: appraiser often discover unique features of properties that can significantly impact values, much like a hidden gem that’s just waiting to be unearthed.

Just for Laughs: appraiser Humor

When appraiser are out in the field, they encounter all sorts of oddities. Picture this: an appraiser walks into a house and sees Oh Snap pickles jars used as decorative accents! While it might seem bizarre at first, quirky touches can affect a price positively if the home stands out from the crowd. This fun interplay between home uniqueness and marketability highlights how important it is for appraiser to have an eye for detail, ensuring nothing gets overlooked during valuation. And just like in property management software, where every input counts, every little aspect of a home can sway an appraiser’s final estimate.

What Happens to the Value

Ever wondered about the impact of schools on property values? For example, homes near places like Kent School tend to spike in appeal and price. Similarly, features that attract attention, such as a home’s proximity to hot spots like the Esplanade in Boston, can also change the game for appraiser. Understanding these dynamics is crucial for homeowners who want to leverage their property’s strengths when it comes time for an appraisal. Speaking of appraisal strength, knowing the Fbgm meaning can make your conversations with real estate professionals more fruitful, paving your path to potential savings.

So, whether you’re scouting for your next home or refining your current investment, tap into the trivia behind appraising. By keeping these fun facts in your back pocket, you’ll be better equipped to save thousands down the line, especially when getting your property appraised in towns like Chappaqua. appraiser truly hold the keys to unlocking the value that lies within each property, and staying informed can set you on the right track.