When you’re stepping into homeownership, it’s crucial to get a grip on your finances. A mortgage estimator is an essential tool that helps first-time buyers understand just how much they can borrow and what their monthly payments might be. But don’t be fooled—using this estimator effectively involves more than just plugging in numbers. In this guide, we’ll break down the important tips you should know to make the most of your mortgage estimator journey, gearing you up for smart decision-making.

Top 7 Tips for Using a Mortgage Estimator

1. Start with Accurate Income Information

Kicking things off, you want to make sure you’re entering the right income figures. Include not just your base salary but also any bonuses, commissions, or part-time gig earnings. For instance, say you have a regular job making $60,000 a year, but you also freelance on weekends and pocket an additional $20,000. It’s super important to include that in your calculations! The more comprehensive your income info, the better your mortgage estimate will be.

2. Understand Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) plays a significant role in how lenders assess what you can afford. Ideally, you should aim for a DTI below 36% if you’re looking at conventional loans, but some programs are more lenient. Let’s do a quick calculation. If you rake in $80,000 a year, your monthly gross income is around $6,667. If your monthly debts sit at $1,500, your DTI would be about 22.5%, showing that you might qualify for larger loan amounts. Keep an eye on this number; it can open or close doors when it comes to loan options.

3. Factor in the Right Credit Score

Your credit score is another big player in this game. Mortgage estimators take this into account to give you an idea of the rates you’re eligible for. Generally, scores above 740 get the best rates. So, if your score is lagging behind, think about ways to boost it before diving into that mortgage application. Utilize services like Credit Karma to check your score and set a plan for improvement.

4. Explore Different Loan Types

Don’t just settle for the traditional route— familiarize yourself with various mortgage types! There’s a range of options, such as FHA, VA, and USDA loans, each suited for different needs. For example, a VA loan might allow veterans to buy without a down payment, which is a great perk. On the flip side, if your credit score isn’t top-notch, you may find an FHA loan more accessible, albeit with mortgage insurance premiums. Knowing what each loan entails will help you pick the one that aligns with your financial situation. If you want to delve deeper into the different types of mortgages, check out this link on mortgage Types.

5. Utilize a Tax Estimator Alongside Your Mortgage Estimator

Tax implications can change the entire picture, so it’s wise to explore how your home purchase will affect your taxes. By using a tax estimator, you can gauge your annual tax burden and understand how homeownership could influence it. For example, the home mortgage interest may be deductible, which can reduce your taxable income. Tools like Intuit ’ s Turbotax can be a handy way to forecast your tax liabilities based on your income and deductions.

6. Include Home Value Estimator for Future Planning

When you’re using the mortgage estimator, consider how a home value estimator could assist your long-term planning. Websites like Zillow and Redfin offer estimates based on current trends and property values. This insight into how your property might appreciate over time can significantly affect your purchasing decision. Always think a few steps ahead; it’s about more than just buying—it’s about investing wisely.

7. Reassess Regularly for Market Fluctuations

The real estate market swings like a pendulum, so it’s key to check your mortgage estimator regularly. Your financial landscape can shift due to interest rates and property values. If you’re eyeing various neighborhoods, like the Bishop Arts district in Dallas, staying updated with regular estimations helps you see what’s feasible. Remember, knowledge is power, and this information allows you to adapt your home-buying strategy if needed.

Wrapping Up Your Home Buying Journey

Venturing into the world of home buying doesn’t have to be intimidating. By understanding mortgage estimators, watching your debt management, and grasping tax implications, you can improve your chances of making an informed purchase. Practicing these estimators alongside keeping tabs on market conditions lets you step into the housing arena with confidence. Don’t hesitate, take these steps and become the savvy buyer you dream of being—your ideal home could very well be around the corner!

For more insights, consider exploring options like cozy Littleton , Colorado or seeking out a 2-bedroom apartment that fits your budget. Happy house hunting!

Mortgage Estimator Fun Trivia and Interesting Facts

The Origin of Mortgage Estimators

Did you know mortgage estimators have been around since the 1980s? Back then, they were primarily used by banks to crunch numbers for home loans. Today, they’ve evolved into user-friendly online tools that help everyday folks get a quick idea of what they can afford. Just like those spooky moments in “The Nun, where the unexpected creeps up on you, a mortgage estimator can help you dodge surprises on your home-buying journey! The best part? You don’t need to be a math whiz. As you enter your figures, the estimator does all the heavy lifting for you.

Understanding Your Numbers

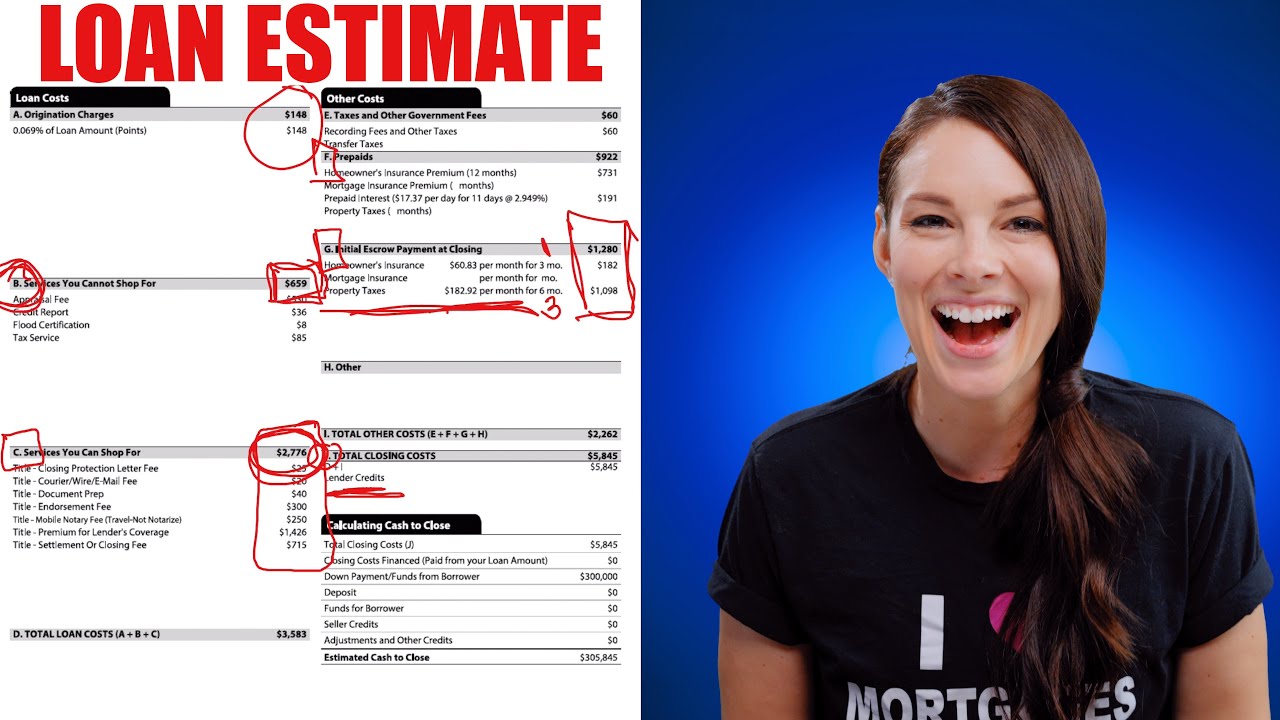

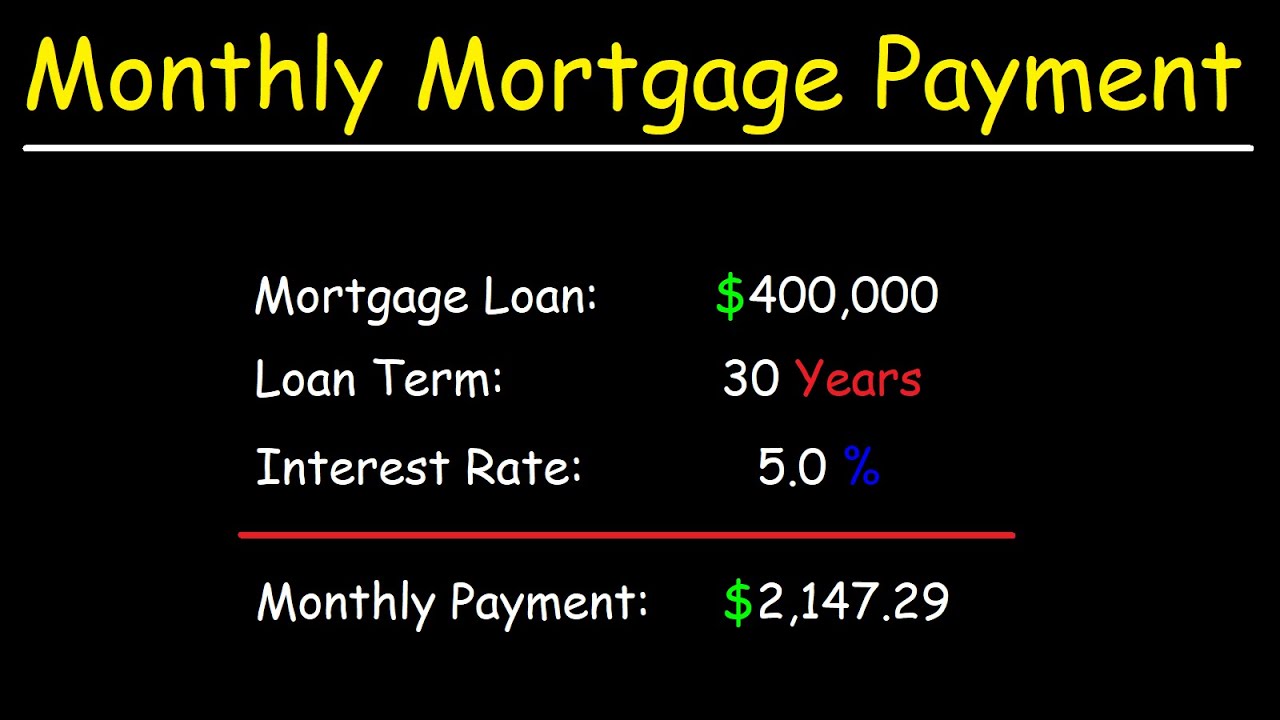

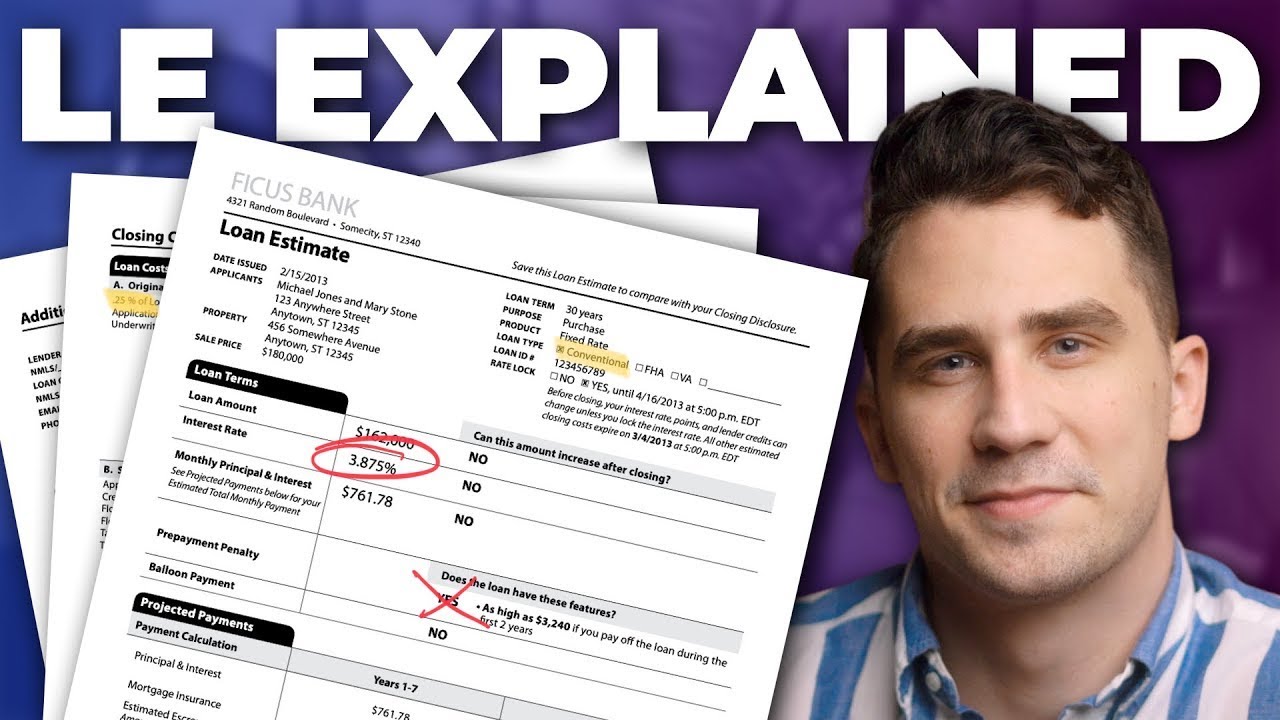

Here’s something quirky: the average American spends about 30% of their income on housing. When using a mortgage estimator, understanding your numbers is crucial. Most estimators require input like loan amount, interest rate, and mortgage term. Think of it as casting a wide net, similar to what Simon Guobadia might do when fishing for great ideas. The more accurate your inputs, the clearer the picture you’ll get of your potential monthly payments. It’s like having your cake and eating it too; you can dream about that home while keeping an eye on your budget!

Market Insights

If you’re feeling overwhelmed, remember this—New Jersey’s housing market has its unique twists. For first-time buyers delving into this market, using a mortgage estimator is like having a trusty map in an unfamiliar territory. It provides clarity in your financial decision-making. And whether you’re in the Garden State or elsewhere, understanding interest rates can save you a pretty penny. In fact, fluctuations in rates can change your estimated payments significantly. So, keep that in mind, and use your mortgage estimator wisely to navigate your home-buying adventure!