When it comes to home financing, Bank of America mortgage rates are turning heads with their remarkably competitive offerings as we step into 2026. Recent trends show fixed-rate mortgages starting at an enticing 3.25%, while adjustable-rate mortgages (ARMs) dip even lower. This combination provides an appealing option for a wide spectrum of borrowers, from first-time homebuyers to seasoned investors looking for budget-friendly alternatives.

The current landscape of mortgage lending is bustling, with various institutions vying for attention. Yet, Bank of America stands out due to its diverse flexible options, whether you’re looking for affordability, stability, or perhaps a mix of both. As we delve deeper, we’ll explore the specifics behind these rates, including the various mortgage offerings that make Bank of America a notable contender in 2026.

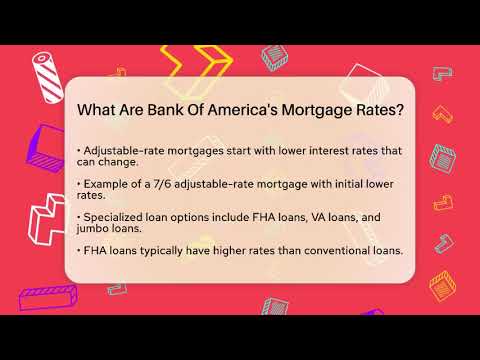

Current Overview of Bank of America Mortgage Rates

As of early 2026, Bank of America mortgage rates paint a promising picture. Fixed-rate mortgages begin around 3.25%, a rate that’s become very enticing for many prospective buyers. If you’re considering an adjustable-rate mortgage, you might find rates falling even lower, which makes them attractive for those who might not stay put for long. The diversity in their offerings really speaks to different buyer needs—whether you crave the reassurance of a stable payment for several years or the potential for lower initial rates.

With the housing market shifting, it’s crucial to look at how external conditions can shape these rates. Economic signals such as inflation, and changes in lender policies keep potential borrowers on their toes. It’s not just about finding the lowest rate; it’s about understanding your financial position and what could work best for you.

Diving into the specifics, let’s embrace the offerings that give Bank of America some serious street cred in the mortgage arena.

Top 5 Low Mortgage Offerings by Bank of America

When it comes to mortgage products, Bank of America certainly doesn’t leave you wanting. Here’s a look at five of their most compelling mortgage options:

Each of these options has merit and can be attractive under different circumstances. Ultimately, it depends on your financial situation, future plans, and how comfortable you are with variable rates.

Comparing Bank of America Mortgage Rates with Rivals

Now, let’s take a step back and see how Bank of America stacks up against its competition. Understanding how Bank of America mortgage rates compare to others can help ensure you’re making the right choice.

Despite these competitive rates from other lenders, Bank of America maintains a strong position in the market with its diverse offerings. This variety helps cater to a broad audience, ensuring there’s something for everyone.

Factors Impacting Bank of America Mortgage Rates

Understanding the landscape of lending involves knowing what factors influence Bank of America mortgage rates today. Here’s a closer look at the elements shaping today’s rates:

By understanding these factors, you can strategize your approach to obtaining a mortgage that best fits your needs. Whether improving your credit score or being mindful of economic shifts, knowledge goes a long way in securing favorable terms.

Tips for Securing the Best Bank of America Mortgage Rate

To make the most of the low Bank of America mortgage rates, consider the following strategies:

It’s essential for homebuyers to research thoroughly and evaluate all mortgage options available. Knowledge is power, and in this case, it also equates to savings.

Bank of America presents a thriving suite of options designed for both new and seasoned homeowners. As we progress through 2026, their variety of mortgage products makes the home-buying process more attainable. With a little due diligence, potential borrowers can make informed decisions that align with their financial goals.

For further insights, why not check out some articles on topics like FHA loan rates here or visit Zoo knoxville to understand more about community involvement and housing suitability.

In conclusion, Bank of America stands strong, providing unbeatable rates and adaptable options that can make your dream home a reality.

Bank of America Mortgage Rates: Fun Trivia and Interesting Facts

The Journey of Interest Rates

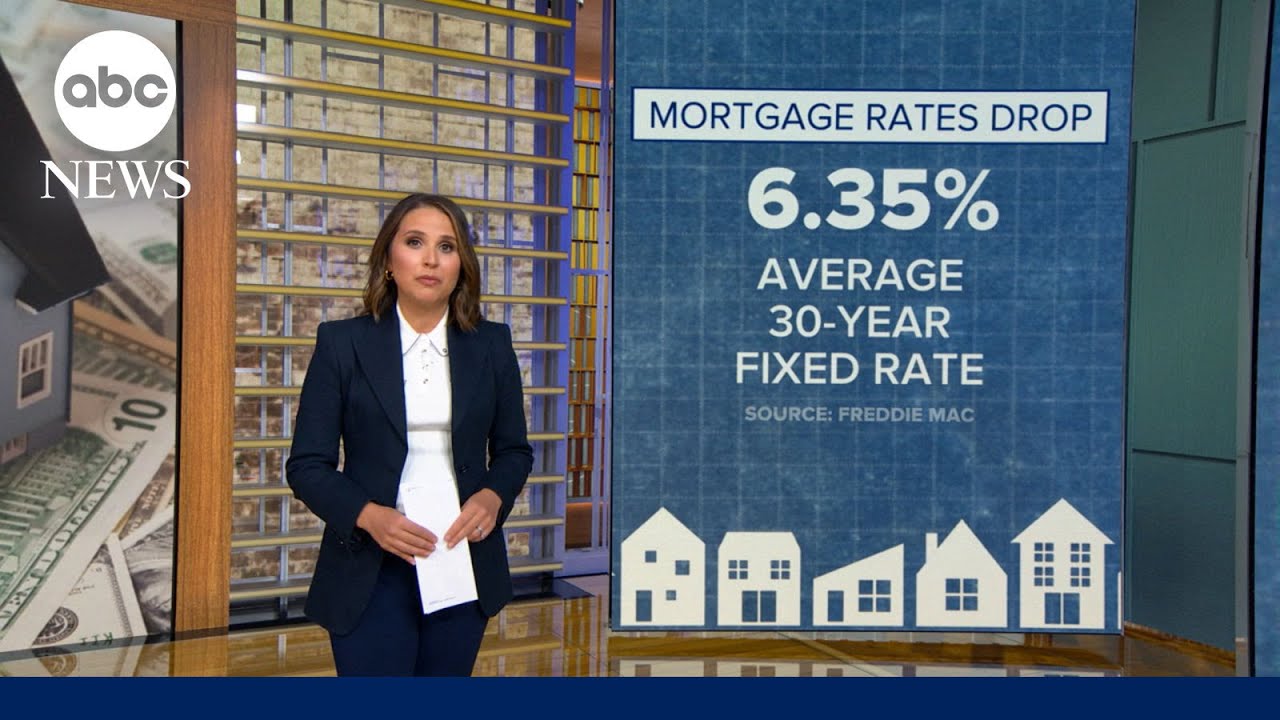

Did you know that mortgage rates can fluctuate based on various factors? For instance, the 30-year mortgage rates have been a staple option for many homebuyers, often regarded as the go-to choice. Back in the day, rates were considerably lower, but today, Bank of America remains competitive, offering incredible low options that might surprise you. In fact, many first-time buyers wonder, “How much Is a” typical mortgage these days? Understanding this can be key to making informed decisions as you dive into homeownership.

Quick On the Draw!

Let’s talk trivia! Did you know that the real estate industry has its share of movie connections? Take “The Hot Chick” cast, for instance. While it may seem like a fun teen comedy, the movie features some wild property mishaps that can teach you a thing or two about the importance of a solid mortgage plan. Whether it’s about selecting the right rates or understanding What Is a lien , These Tidbits offer a glimpse Into The lighter side Of Homebuying .

The Bizarre World of Mortgage Choices

Shifting gears, you might be curious about quirky trends in the mortgage industry. For instance, many people often feel they need to relinquish their hopes of buying a home due to tough financial markets. However, with Bank of America’s attractive mortgage rates, you could be closer to homeownership than you think. You’ll also encounter some peculiar financing options, like sub-prime loans or even peculiar gimmicks like “Fushigi,” a spinning ball that captures interest and imagination! With such a diverse landscape of choices, it’s clear that keeping up with Bank of America mortgage rates could spark curiosity and excitement on your home-buying journey.