Buying a house can be an exciting yet challenging journey, especially for first-time buyers. With the real estate market constantly shifting, understanding what it means to buy a house in 2026 has never been more crucial. Think about interest rates, housing supply, and how the economy plays into your choices. Right now, interest rates appear stable after experiencing ups and downs in prior years. This stability creates a more predictable landscape for first-time buyers aiming to secure a mortgage.

To help you navigate the market, here are seven essential secrets that can empower you in your quest to buy a house. From understanding mortgage options to exploring diverse housing types, let’s dive in!

Top 7 Must-Know Secrets When You Buy House

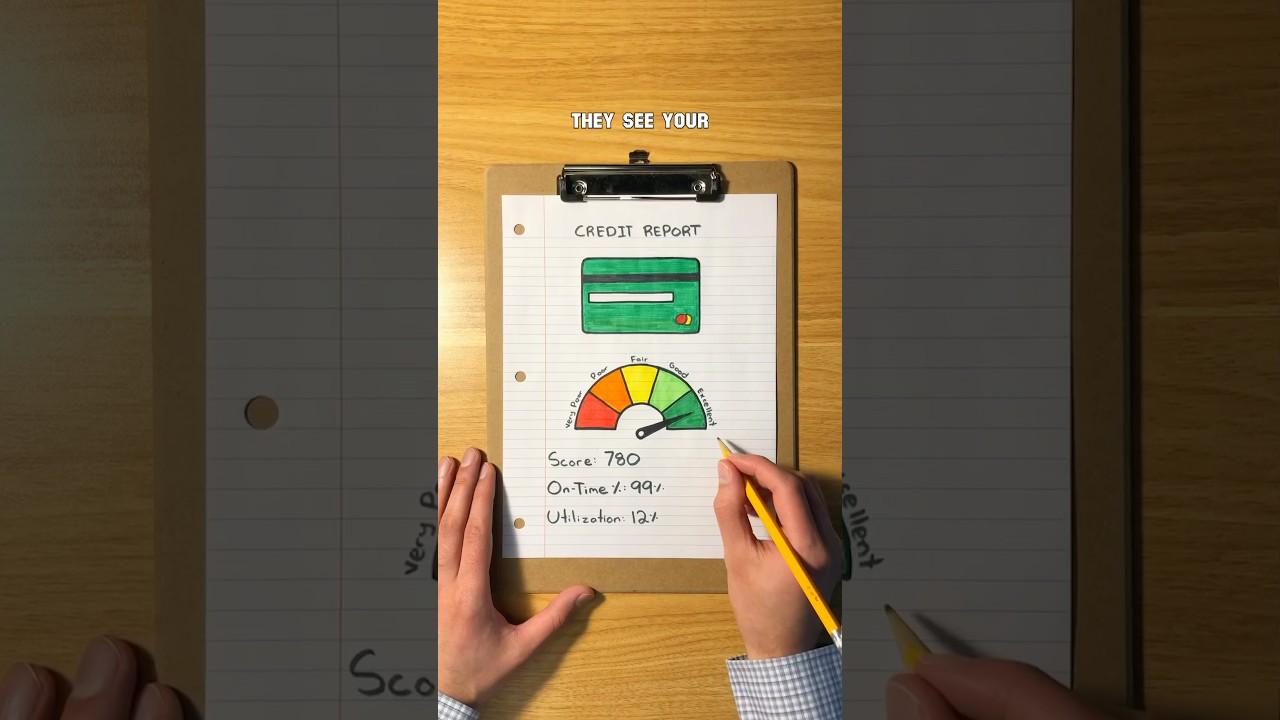

1. Getting Pre-Approved for a Mortgage is Essential

Many first-time buyers don’t realize just how critical it is to get pre-approved for a mortgage. In competitive markets, homes fly off the shelves. If you’re pre-approved, it shows sellers you mean business and have the means to follow through. This isn’t just a formality; it gives you leverage and clarity on what you can afford. Lenders like Quicken Loans or Wells Fargo can get you pre-approved in no time, providing helpful insight into your loan options.

2. Location Matters: Alert to Emerging Neighborhoods

Let’s talk location! While the old real estate adage is “location, location, location,” it’s important to also consider emerging neighborhoods. Areas such as the Italian Village in Columbus, Ohio, are undergoing revitalization and drawing in younger homeowners. You can find affordable homes with the potential for good appreciation. Investing in these up-and-coming spots can pay off as they grow and develop.

3. Assess the True Cost of Your New Home

When you set your sights on a property, remember it’s not just about the sticker price. You need to consider additional expenses like property taxes, homeowner’s insurance, and ongoing maintenance. A charming big house can come with hidden costs that might stretch your budget. Conversely, exploring options like a tiny house can offer a cost-effective lifestyle without skimping on modern essentials.

4. Not All Mortgage Options are Created Equal

Understanding the world of mortgages can seem overwhelming, but it’s essential. Fixed-rate loans provide consistency, while adjustable-rate mortgages (ARMs) may offer lower initial payments but can fluctuate. A 5/1 ARM might lure you in with an appealing rate for five years, but be aware that it could spike significantly afterward. Weigh your current and future financial situation to choose wisely.

5. Home Inspections are Non-Negotiable

It’s tempting to skip a home inspection to save time or money, but don’t do it! Whether you’re looking at a shotgun house or a cozy townhouse, getting an inspection is vital. Inspections reveal potential problems that could lead to costly repairs later. Reputable firms like Pillar To Post or HouseMaster can provide you with a thorough inspection, ensuring you’re not left with any nasty surprises.

6. Closing Costs are More Than Just a Line Item

Ah, the infamous closing costs! Many first-time buyers don’t realize these can range from 2% to 5% of the loan amount. It’s crucial to factor in not just the down payment, but also title insurance, appraisal fees, and other costs. Understanding these expenses can help ensure a smooth closing experience rather than a nasty shock at the finish line.

7. Take the Time to Negotiate

Don’t forget that negotiation is part of the game! You can negotiate not just on the sale price, but also on terms such as closing costs and repairs. Remember, sellers often build a buffer into their asking price! Engage real estate professionals who can equip you with effective negotiation strategies. For those in Rhode Island, using services like Zillow Rhode island can help streamline the process.

Exploring Diverse Housing Options: Houseboats, Shotgun Houses, and More

As home buyers explore their options, unique housing types are gaining traction. Houseboats, for instance, are becoming increasingly sought after for those craving a distinctive lifestyle near the water. Meanwhile, shotgun houses are also resurging, especially in urban locales like New Orleans where space is precious. These elongated homes offer smart layout solutions that are appealing to younger and more eco-conscious buyers.

Townhouses vs. Single Family Homes

If you’re torn between townhouses and single-family homes, there are key differences to weigh. Townhouses generally require less upkeep and often feature community amenities. This makes them ideal for first-time buyers who want to engage with neighbors without hefty yardwork. On the flip side, if privacy and outdoor space are top priorities, investing in a single-family home may be a wise choice for long-term benefits, especially for families.

Final Thoughts on Making Your Home Buying Journey Successful

Embarking on your home buying adventure can feel overwhelming, but it doesn’t have to be. Equip yourself with the right knowledge and you can face the process with confidence. Stay tuned in to market trends and broaden your horizons regarding housing options. Whether it’s a snug townhouse in an Italian village or a spacious tiny house, there’s a fit for everyone. With these insider secrets, you’ll be well-prepared to make choices that bring long-lasting joy and stability to your life—and who wouldn’t want that?

Being informed is your best asset in this thrilling journey of buying a house. Don’t rush; take the time to learn, explore, and find what truly fits your lifestyle!

Buy House: Fun Trivia and Interesting Facts

The Surprising Journey to Home Ownership

Did you know that an impressive number of first-time buyers seek homes outside big city limits? In fact, many find the best deals in suburbs. This trend’s akin to how some folks, like Souheila Yacoub, discover hidden gems far from blockbuster hotspots. And speaking of hidden gems, did you know that New Jersey boasts some of the oldest homes in the country? You can explore a map Of New jersey to see how much history resides there, often waiting for the right buyer to bring them back to life.

Mortgage Trivia and Buyer Preferences

When you’re ready to buy a house, knowing your mortgage options can feel like a scene from a frightening flick, reminiscent of a scary movie cast lineup! According to surveys, first-time buyers are most interested in fixed-rate mortgages, with nearly 90% opting for this route. This ensures a sense of stability amidst the myriad of choices, much like navigating through the lively Gaslamp district in San Diego, a great spot for exploring real estate variety.

Unique Accessories and Home Maintenance Tips

Before sealing the deal on your dream home, here’s a quirky tidbit: did you know that just as Wasp Traps help manage pests, smart home devices can enhance your living experience? Many homeowners are incorporating these features into their spaces right from the start, making their new houses feel like home. And for those with an eye for vibrant neighborhoods, having a look through the listings on Www.realtor.com can be a treasure hunt in itself!

Taking all this into account, it’s clear there’s more than meets the eye when you venture to buy a house. From understanding your finance options to exploring neighborhoods, each step is an adventure filled with opportunities for fun and discovery. Whether you’re in it for the long haul or just testing the waters, remember that every fact about home buying just might inspire your journey!