In today’s financial world, the car loan calculator Google tool has become an essential resource for anyone looking to buy a car. This handy calculator allows users to estimate their monthly payments by simply entering their loan amount, interest rate, and loan term. As car prices swing up and down, having a dependable method to calculate costs can help buyers make informed decisions. With Google’s user-friendly integration of this tool, budgeting and planning become less stressful and more straightforward.

1. Understanding the Car Loan Calculator Google

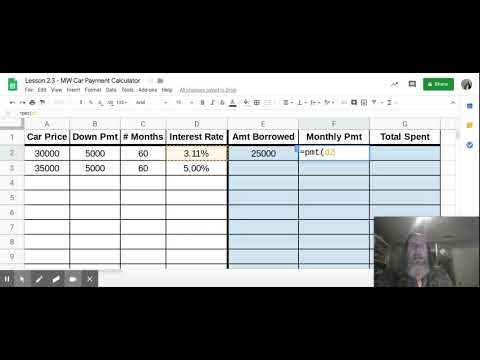

The car loan calculator Google is not just another online tool; it’s a financial ally. By inputting basic details like loan amount and interest rates, users can quickly see how their choices affect monthly payments. This insight is invaluable in today’s fast-paced car market where prices can vary significantly based on trends, promotions, or even seasonal sales. Knowing what to expect in terms of monthly payments can prevent financial strain down the road.

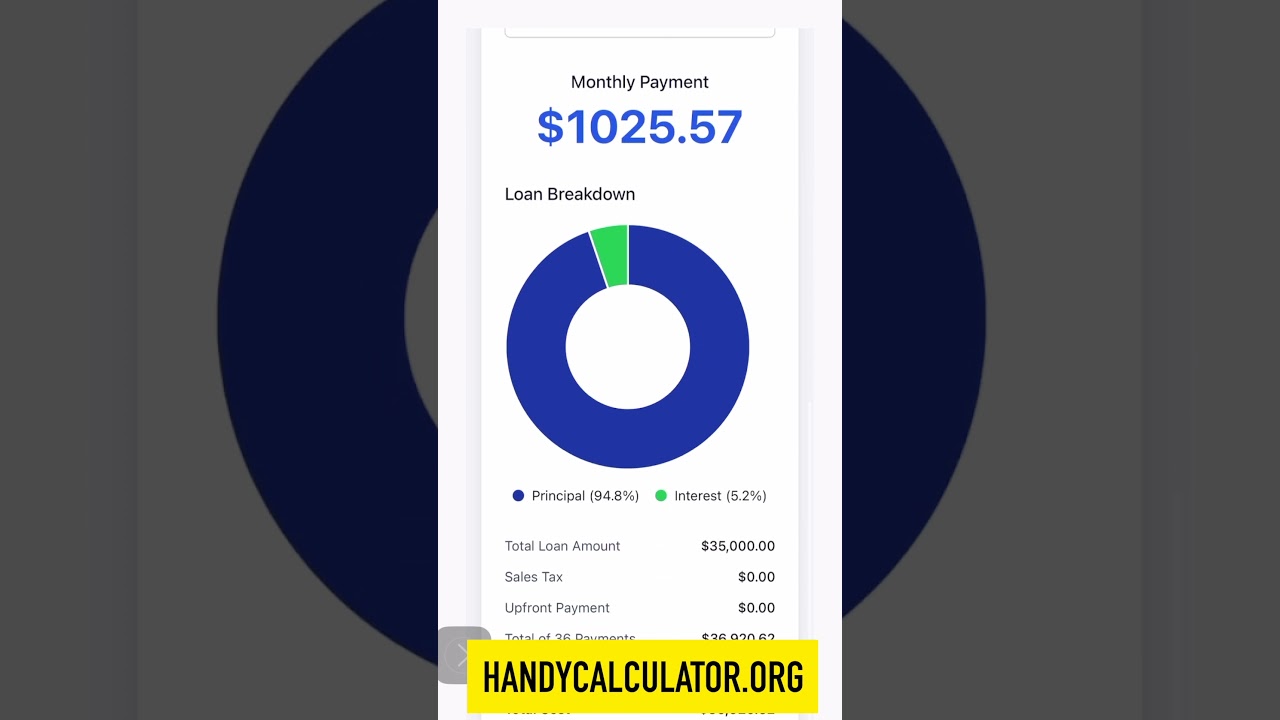

For example, let’s say Sarah, a first-time car buyer, wants to finance a sleek hatchback priced at $20,000 with a 5% interest rate over five years. By utilizing the car loan calculator Google, she’ll get instant feedback on her potential payments, which helps her gauge what fits her budget. This tool not only saves time but also leads to more informed purchasing decisions.

Moreover, as individuals consider additional costs such as insurance, maintenance, and any potential financing fees, having a clear understanding of how car payments fit into their overall budget is crucial. That’s why the car loan calculator Google stands out – it takes the guesswork out of car financing.

2. Top 7 Benefits of Using the Car Loan Calculator Google

Using the car loan calculator Google comes with an array of benefits:

The intuitive design of Google’s car loan calculator ensures that even those new to car buying can navigate it easily. The layout is clean, allowing users to see what they need at a glance.

This tool draws on live interest data, so the estimates you receive are based on current market conditions. For instance, if you adjust the loan parameters to match current offers from dealerships like BMW or Honda, you’ll see a realistic assumption of what to expect.

One standout feature is the ability to compare different loan scenarios. Buyers can visualize how changes in interest rates or loan terms impact their total costs, empowering them to choose the best option for their needs.

The calculator works well with other financial tools. For example, if you use the paycheck calculator Florida, you can analyze your income alongside your car costs. This comprehensive view helps maintain holistic budgeting strategies.

With precise calculations in hand, buyers can negotiate more effectively. Suppose your expected monthly payments are higher than anticipated; you’d be better positioned to negotiate terms that suit your financial situation.

Want to see how extra payments reduce loan duration or interest? This tool lets users simulate additional payments, allowing them to explore potential savings.

You can factor in potential trade-ins or down payments, assisting long-term financial planning. If you think about using a HELOC payment calculator, this feature proves particularly useful for budgeting future purchases.

3. Real-Life Applications of the Car Loan Calculator Google

Let’s dive into how real people are benefiting from the car loan calculator Google. Take Sarah again, the teacher from Florida. During her search for a reliable vehicle, she started using the calculator. By tweaking her loan details, she found that extending her loan term by just a year significantly reduced her monthly payments, which allowed her to choose an option that easily fit her budget.

Tom and Lisa, a couple with a growing family, also turned to the calculator. They compared different financing offers from various lenders and found that one lender, offering a lower interest rate, saved them thousands in interest over the life of their loan. This calculator transformed them into informed buyers, enabling better decision-making tailored to their family’s needs.

Having real-life examples like these highlights how the car loan calculator Google can empower consumers. The tool not only aids in determining monthly payments but can also play a massive role in budget management, ensuring that buyers stay within their financial means while upgrading their transportation.

4. Enhanced Financial Awareness Through Calculators

Using the car loan calculator Google enhances financial literacy. Engaging with this tool lets users hone their calculation skills, transforming complex financial principles into manageable insights. Not only do buyers learn about automobile financing, but they also uncover valuable budgeting lessons applicable in various life choices.

By connecting insights gained from the car loan calculator with resources like the bankrate mortgage calculator, users can gain a well-rounded view of their overall financial health. Grasping how a car loan influences personal finances encourages thoughtful planning for other investments or essential expenses.

Essentially, the better you understand your finances, the more empowered you’ll feel when managing them. This kind of awareness can dictate how well you navigate not just car purchases but also bigger financial commitments like home buying or refinancing their existing loans.

5. Final Thoughts on Navigating Your Financial Future

In summary, the car loan calculator Google is a vital component for modern vehicle buyers, giving them tools to make sound budgeting choices in an intricate car market. By utilizing this resource in conjunction with complementary calculators, individuals can grasp their finances fully, leading to smart purchasing decisions. Whether you’re stepping into the market for the first time or looking to fine-tune your existing loan, these tools are essential for paving a path toward a secure financial future.

So, if you’re out there weighing options and figuring out your next move, remember: leveraging smart tools like the car loan calculator Google, along with other resources, prepares you to manage your finances confidently, allowing you to drive away happy with the right car at the right price.

Car Loan Calculator Google: Your Smart Tool for the Road Ahead

When it comes to understanding the financial snippets of life, the car loan calculator Google provides a quick and effective way to estimate what your monthly payments might look like. Did you know that the average American spends around $4,000 a year on just gas? Crazy, right? That’s why knowing your loan terms can help ensure you’re budget-savvy about your next vehicle purchase.

Fun Financial Tidbits

Here’s a fun fact: using a net pay calculator can help you see what money really lands in your pocket every month, giving you clarity as you crunch numbers for that shiny new car. Speaking of shiny things, do you remember that famous scene from Monty Python And The Holy grail about the knights using coconuts to simulate horses? It just goes to show that transportation’s been a hot topic for ages! But unlike those knights, most of us will need to finance our rides—hence the importance of a solid car loan calculator Google to plan your budget effectively.

Loan Basics: What You Should Know

Before diving in, it’s clear that choosing the right loan size can make a world of difference. Take the towns of Amherst, MA, and Hudson, MA, for instance. If you’re considering buying a car in either location, remember that financing options might vary based on local markets. And remember, figuring out your payments isn’t just abstract math; it directly relates to your day-to-day life and financial health, especially on days like suicide awareness day, when we reflect on the pressures many face.

Putting It All Together

It’s exciting to find tools like a car loan calculator Google that help you visualize your finances! You might even think of it as picking out the perfect pair of born boots women for that added comfort during your drives. Did you know some people create a fursona when customizing their car’s vibe? It’s fun and uniquely personal, just like picking the right loan! So why not use every tool at your disposal? Don’t forget, if you’re ever pondering about home financing, there’s also a handy mortgage calculator Google waiting to help you out. Now, go ahead and hit the road with confidence!