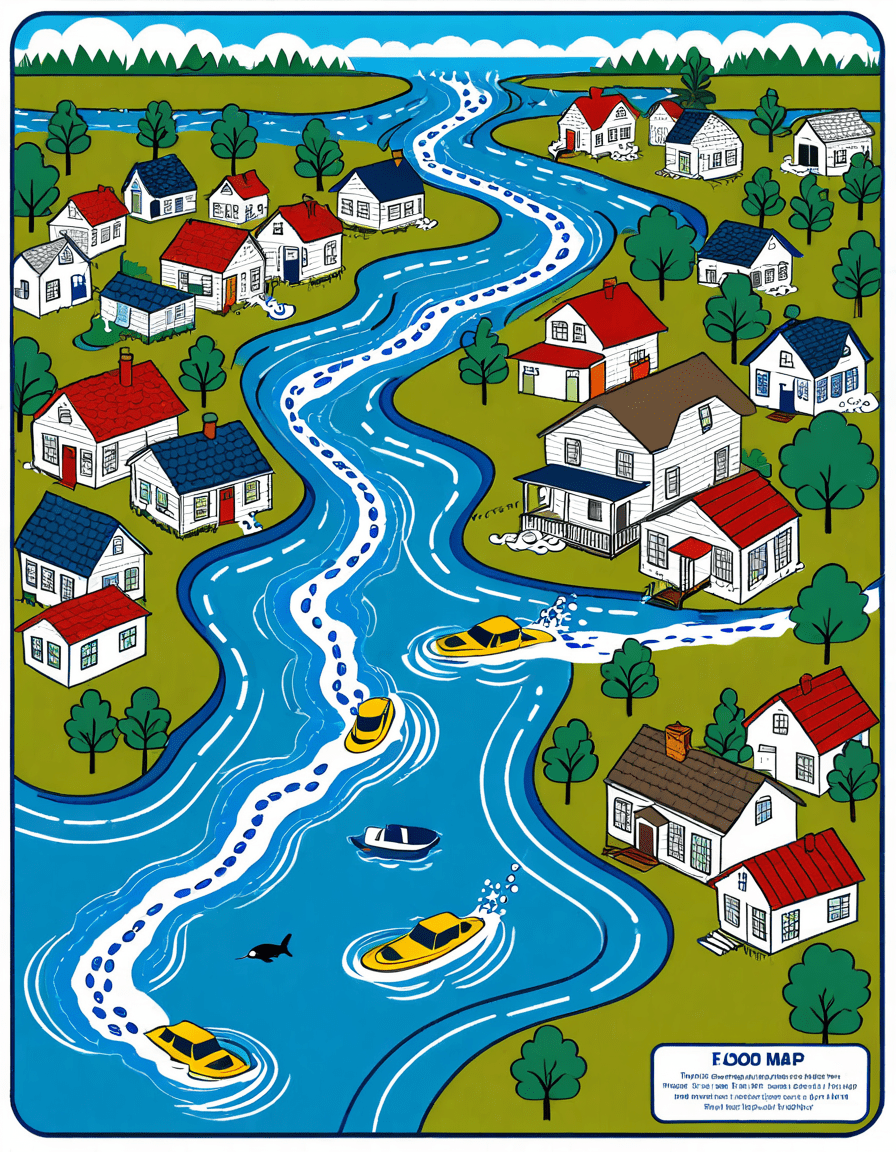

Understanding the FEMA Flood Map is vital for anyone involved in real estate. Whether you’re a first-time homebuyer, a seasoned investor, or a homeowner looking to refinance, knowing how to interpret this essential tool can protect your investment against potential disasters. The FEMA Flood Map categorizes areas based on their flood risk, offering insights that can shape your property decisions. Understanding flood zones—like Zone A (high-risk) or Zone C (low-risk)—is essential before purchasing or investing in a property.

Understanding the FEMA Flood Map: A Tool for Flood Risk Assessment

1. The FEMA Flood Map: A Deep Dive into Its Functionality

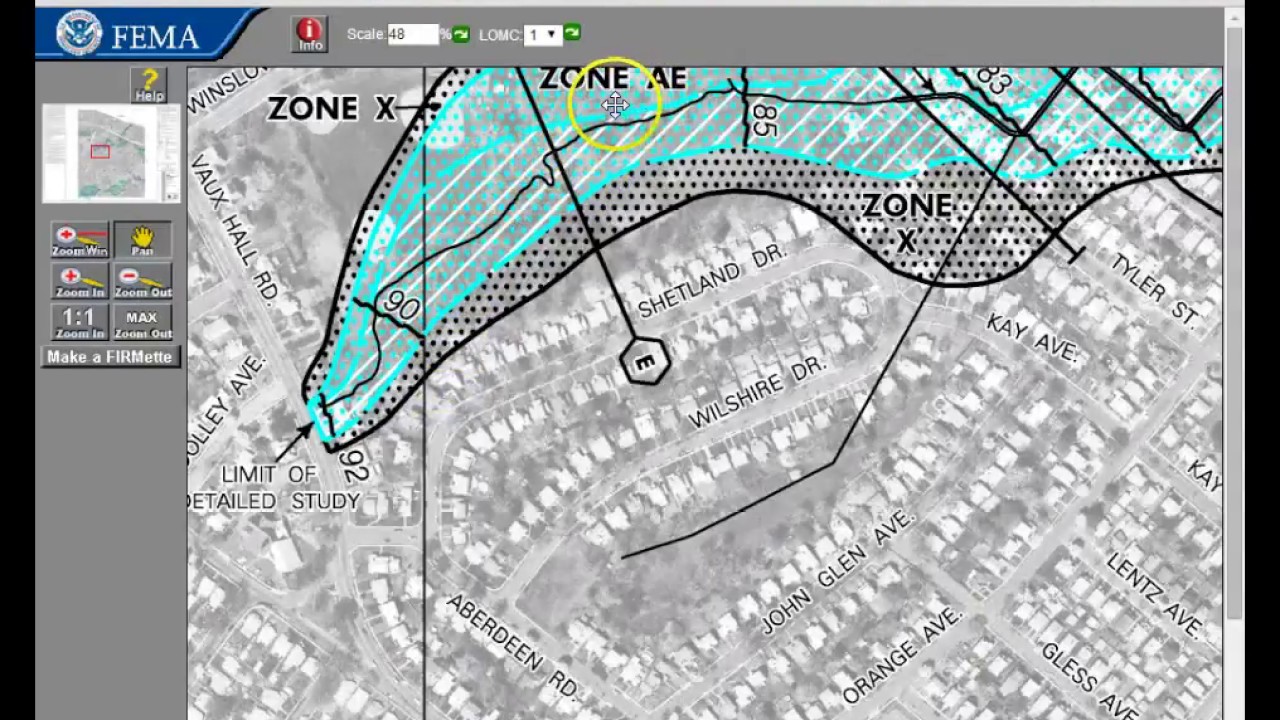

The FEMA Flood Map serves as a crucial resource developed by the Federal Emergency Management Agency to assess flood risk across the United States. Homebuyers and homeowners must familiarize themselves with this map since it categorizes regions into flood zones—A, B, C, and V, among others. Flood Zone A, for example, carries a one in four chance of flooding during a 30-year mortgage term. Understanding these categories makes it easier to gauge your risk exposure before you buy a property, so you won’t find yourself with unexpected issues down the line.

Additionally, the map is regularly updated based on changing weather patterns, rising sea levels, and new data. This dynamism makes it necessary for homeowners to remain informed. To illustrate, places like Florida and Louisiana experience constant revisions due to evolving climate risks. Being attentive to these updates can save buyers from facing financial losses in the long run.

2. Top 5 Critical Insights from the FEMA Flood Map

Understanding the insights derived from the FEMA Flood Map can significantly impact decisions for homebuyers and insurance policies. Here are five key insights gleaned from recent updates to these maps:

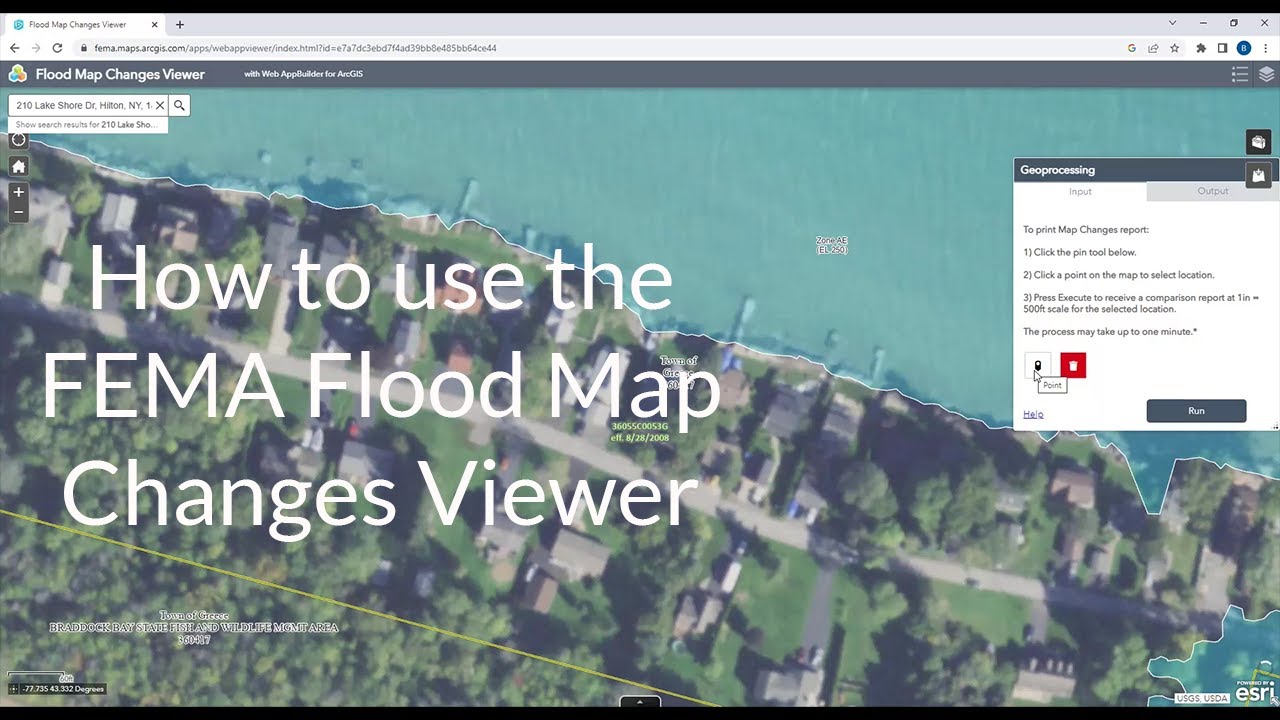

3. How to Use the FEMA Flood Map Effectively

Navigating the FEMA Flood Map takes skill and understanding. Here are strategies homebuyers can adopt:

4. Current Trends in Flood Insurance: Responding to the New FEMA Guidelines

With the shifting dynamics in flood risk assessment, flood insurance has evolved. The recent updates from FEMA necessitate that homeowners in impacted areas adjust their policies, often resulting in higher premiums. For example, in 2026 alone, flood insurance rates in states like New Jersey have surged as the maps reflect expanded risk zones.

Homebuyers must collaborate with insurance agents to navigate their options effectively, considering multiple policy providers for competitive rates. It’s essential to shop around; you may find similar coverage with varying premium costs from different companies. Understanding your own property’s risk profile can help you tailor your insurance policy to fit both your needs and budget.

Additionally, pay close attention to any federal or state grants available for flood-proofing your property. These can help offset the costs associated with increased insurance premiums, enabling homeowners to protect themselves without breaking the bank.

5. The Future of FEMA Flood Maps: Innovations on the Horizon

Looking forward, we anticipate further innovations in how FEMA Flood Maps will serve communities. A move toward a more interactive and user-friendly interface, similar to platforms used in weather forecasting, could revolutionize how homeowners engage with this critical resource. This might include real-time updates powered by machine learning algorithms, allowing users to adjust their planning based on current risk levels.

Innovative practices might also incorporate feedback from local communities to refine flood mapping. For instance, forums like Community Design Workshops could parallel the participatory approach seen in city planning, ensuring that local knowledge informs flood risk assessments.

These advancements could empower homeowners to make better decisions, allowing them to adapt to rapidly changing environmental conditions. As technology improves, residents will gain more valuable insights, making it easier to identify vulnerabilities and take proactive measures.

Final Thoughts: Leveraging FEMA Flood Maps for Informed Home Buying

Leveraging the FEMA Flood Map effectively can be a game-changer for both first-time buyers and seasoned homeowners. By understanding the details behind the map, recognizing its implications on real estate, and being aware of emerging trends, buyers can protect their investments and make informed decisions.

As climate change reshapes our landscapes, the importance of accurate flood risk assessment—combined with proactive local responses—has never been more critical for sustainable living. It’s clear that being informed opens the door to better choices in home buying and beyond.

If you’re considering your next property purchase or refinancing your existing one, don’t overlook the FEMA Flood Map as a reliable resource. It can save you from a world of financial hurt. Remember, in today’s world, knowledge is power. So dive into the map, stay updated, and make smart choices that will secure your future in homeownership.

If you’re interested in exploring more about community preparedness, check out resources like Wilson Park and schools such as Primrose Schools to understand how local planning initiatives focus on resilience and safety.

Fun Trivia and Interesting Facts About the FEMA Flood Map

A Look at the Origins

The FEMA flood map is more than just a chart; it’s a crucial resource for communities across the U.S. Originally initiated in the 1970s, this program emerged in response to escalating concerns about flooding risks, especially after natural disasters laid waste to entire towns. Did you know that flood zones are categorized into varying risk levels? These levels help homeowners and builders make informed decisions. If you’re curious about travel plans that start from central time converting to eastern time, check out our guide on 3pm central to eastern. Just like understanding time zones can save you headaches on vacation, knowing your flood risk can save you a lot of stress when buying a home.

Why Flood Zones Matter

Understanding the FEMA flood map ensures that people aren’t caught off-guard by unexpected disasters. For instance, homeowners in high-risk zones might need flood insurance, while those in low-risk areas may be exempt. It’s like the difference between owning a pair of tiffany air force 1 shoes versus the classic standard; one might give you peace of mind, and the other focuses on fashion. Similarly, being prepared means protecting your biggest investment—your home. And if this whole flood thing sounds too serious for a bit, consider indulging in your favorite flavors by checking out Penzeys Spices for a little culinary inspiration.

The Future of Your Property

Predicting flood risk can feel overwhelming, but the FEMA map acts as your lifeline. Just as Effingham boasts unique historic spots that people flock to for culture, flood maps provide unique data that can shape where people choose to live. Ever thought about how some properties increase in value while others don’t? A home situated in a flood-prone area might lose value quicker than a property that’s in a more stable zone. As for the emerging patterns in property purchases, it’s vital to stay informed. After all, those trends can shift faster than you can say Nyomi Banxxx, especially as more people become aware of climate impact.

So, the next time you hear about a FEMA flood map, remember it’s not just lines on a paper. It’s a tool that brings clarity and safety into the unpredictable world of home buying and property ownership, much like knowing 15 kg to lbs can help keep your health in check. Whether you’re considering a new home in Ocala or elsewhere, keep that flood risk at the forefront of your home-buying journey!