When diving into the world of homeownership, understanding how a mortgage works is crucial. Not just any mortgage will do; knowing the specifics can make a significant difference in costs over time. Now, imagine this: a fixed-rate mortgage versus an adjustable-rate mortgage (ARM). With fixed rates, your monthly payment stays the same—like having a reliable car that won’t spring surprises on you. Meanwhile, ARMs can start with a lower rate but can fluctuate, leading to potential budget blowouts later on. Weighing these options is vital.

Your credit score plays a pivotal role in securing the best mortgage rates. For instance, if your score is 740 or higher, get ready to save thousands compared to someone with a score of, say, 620, who might face higher rates. Don’t underestimate the importance of a good score! Additionally, the loan-to-value ratio is another critical factor. If you can muster up a 20% down payment, you can avoid private mortgage insurance (PMI), ultimately keeping more cash in your pocket.

## Mortgage Tips That Will Save You Money Today

Let’s break down some practical mortgage strategies that can help you save now and in the long run, accommodating various regional needs and quirks.

Strategy 1: Local Lenders and Mortgage Brokers – A Tailored Approach

Tapping into local lenders can give you the upper hand, entirely unique to your area. In Julian, CA, for example, credit unions often provide competitive rates and a personal touch, reflecting community values. Meanwhile, if you find yourself in Independence, MO, local banks may offer programs designed specifically for first-time buyers, reducing rates and fees you’d face elsewhere. Engaging with community banks like Bella Terra in Doral can lead to significant financial advantages due to their desire to foster good relationships with clients.

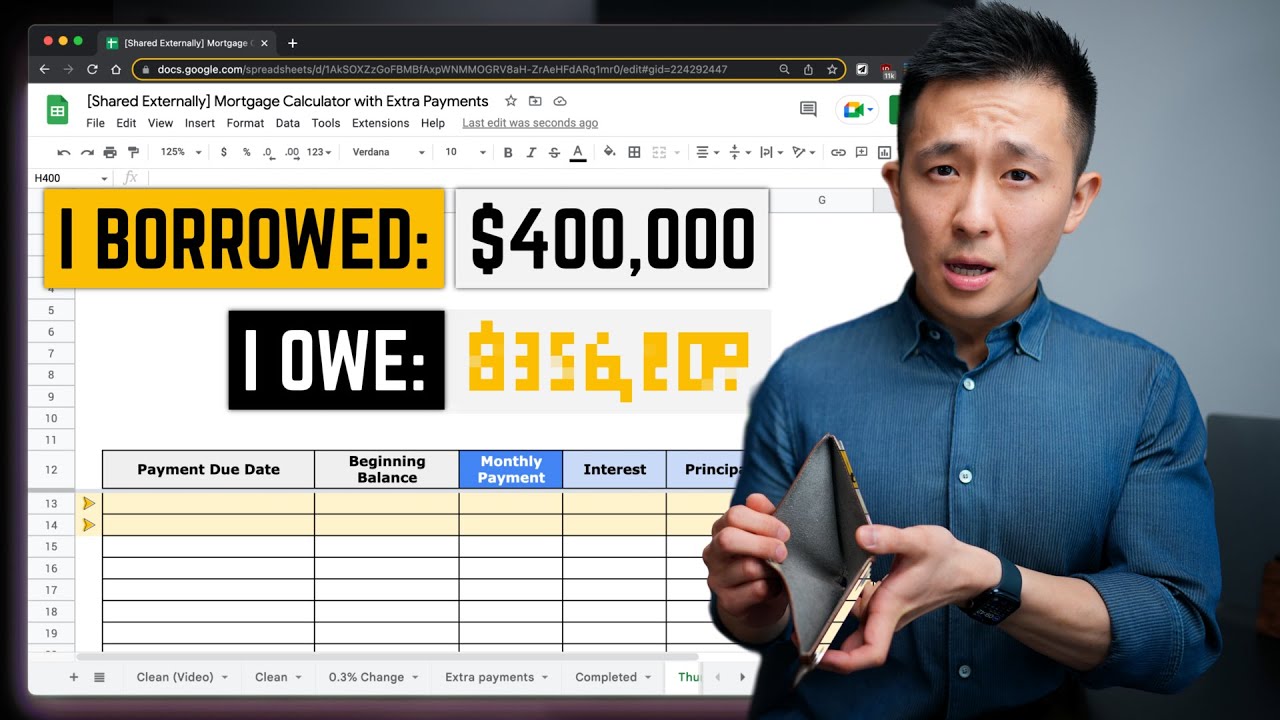

Strategy 2: Utilize a Mortgage Calculator for Smarter Decisions

Hands down, using a mortgage calculator can save a lot of mental gymnastics. Local organizations, like MIBOR in Indiana, offer great tools that show how different amounts and rates affect your mortgage. Consider this: if you’re deciding between a 30-year fixed mortgage at 3.75% and a 15-year at 2.85%, running the numbers can reveal if that lower interest rate for a shorter term is worthy of the heftier monthly payment.

Strategy 3: Negotiate Your Closing Costs

Many buyers gloss over the closing costs, which can range from 2% to 5% of the loan amount. Newsflash: You don’t have to take them as is! Buyers can negotiate these costs, especially when working with brokers like Sal or in competitive markets like Aurora, IL where homebuyers are plentiful and lenders are keen for business. Don’t hesitate to ask for a discount!

Strategy 4: Consider Non-Traditional Loan Options

Don’t forget that there are non-traditional mortgage options out there. FHA loans cater perfectly to first-time buyers in areas like Peoria, IL, offering opportunities even with less-than-stellar credit. Then there are VA loans for veterans in Orinda, CA, which provide unique benefits like no PMI and competitive rates. These alternatives provide an affordable path to homeownership.

Strategy 5: Take Advantage of State Programs

State-assist programs can be a game changer. Programs such as the California Housing Finance Agency’s (CalHFA) assistance for first-time buyers can significantly offset upfront costs. Dig into available local programs that provide down payment assistance or tax credits that apply to your situation. The savings can be staggering!

Strategy 6: Monitor Interest Rates Regularly

Stay vigilant about those interest rates! They sure know how to bob and weave. It’s wise to regularly check for rate drops and market trends. Resources like Lana Condor’s digital newsletter offer timely insights and tips on when to jump into refinancing or taking out a new mortgage.

Strategy 7: Be Prepared to Refinance

Owning a home isn’t a “set it and forget it” scenario. Regularly assessing your mortgage’s position is essential. When interest rates dip, it might be time to refinance. For instance, a family in Doral could see massive savings just from a 2% drop in rates over 30 years—imagine saving tens of thousands!

Innovative Alternatives to Traditional Mortgages

The mortgage landscape is evolving. For example, community land trusts are gaining traction. They allow for cooperative purchase agreements that keep home prices manageable, especially in fast-growing areas like Julian, CA. These innovative solutions create pathways for buyers who face daunting price tags in high-demand markets.

Final Thoughts: Strategizing for Financial Freedom

Navigating the mortgage landscape can feel overwhelming, but it doesn’t have to. By understanding various loan options and taking advantage of local resources, you can craft a mortgage that fits your financial picture perfectly. Remember, being proactive and informed will lead not just to savings today, but also to long-term financial stability. So gear up, dive deep into these strategies, and watch as you pave the way for a brighter financial future!

Whether you’re a first-time buyer or an experienced home shopper, putting these tips into action can set you up for success more efficiently than you might think. Don’t just take our word for it—go out there and start saving!

Mortage: Fun Trivia and Interesting Facts

Curious Facts About Mortages

Did you know that the history of mortgages stretches back to ancient times? The earliest forms of what we now call a mortage can be traced to the early Romans, who had a system somewhat akin to today’s lending practices. Fast forward to now, and today’s mortage options often come with a variety of perks. For instance, some mortages allow you to opt for a unique structure, giving you the ability to choose how you’ll pay back your loan. Curious about the specifics? Thinking of Westmont or Kingsland? Different locations can dictate what type of mortage is most favorable, so it pays to do your homework!

Moving on to a light-hearted tidbit: mortage applications can sometimes feel like a scene from a movie—just consider film and TV stars like Laura Leigh! She’s shown us various roles in her career, much like how your mortage can change with market conditions and personal circumstances. Keeping abreast of these trends can drastically save you money in the long run. Plus, who knew that a little knowledge about your financial foundation could make you feel like a celebrity?

Lastly, let’s talk about something you might not know at all: some lenders can even act like an adjudicator in your financial journey. They’ll evaluate your situation with a keen eye, similar to how some actors sift through scripts for that perfect role. And if your journey takes you to places like St. Moritz Swiss, where property values can skyrocket, understanding the nuances of a mortage could make all the difference. Keep your options open, and always look for ways to save—after all, financial savvy never goes out of style!