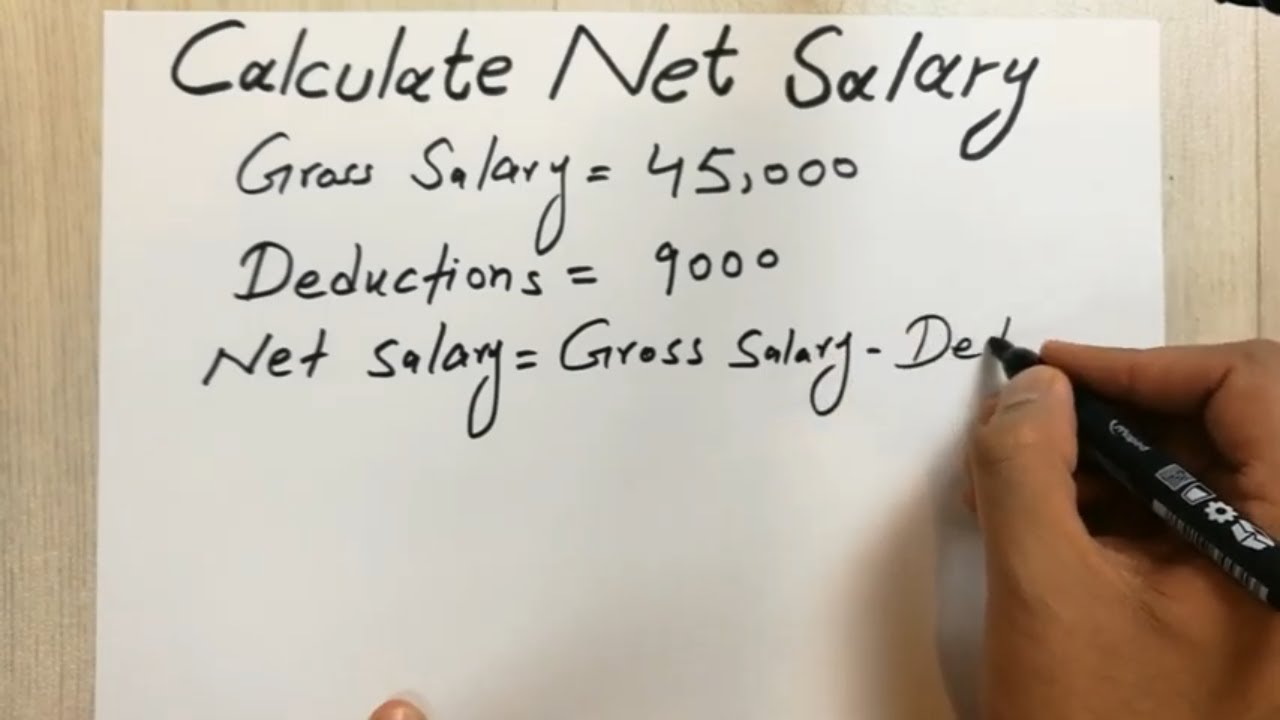

When it comes to managing your finances effectively, knowing your net pay—what you take home after taxes and deductions—is crucial. A net pay calculator can simplify this process, allowing you to gain a clearer view of your financial picture. Additionally, understanding how tools like a simple loan calculator can influence your disposable income is essential for strategic financial planning. Let’s delve into the secrets of using these tools so you can maximize your income and make informed financial decisions.

Top 6 Secrets of Using a Net Pay Calculator for Higher Earnings

1. Know Your Tax Bracket

Understanding your tax bracket is vital to using a net pay calculator. The federal income tax brackets for 2026 show that single filers will have a 22% rate on income exceeding $44,725. Knowing where you land in this chart helps you input accurate data, ensuring your expected take-home pay reflects realistic deductions.

It’s crucial to pay attention to tax law changes annually, as this can directly affect your income tax. By analyzing your tax bracket, you can better anticipate and even plan for the deductions that will impact your net earnings.

2. Consider State and Local Taxes

State taxes can vary widely, and these can significantly affect your net pay. For instance, California residents might dish out up to 13.3% in state taxes, while their neighbors in Florida enjoy no state income tax whatsoever. Inputting these additional tax rates into your net pay calculator will give you a more accurate understanding of your earnings.

Remember that some states also impose local taxes. For example, New York City has a local income tax rate that can be as high as 3.876%. Always account for these factors so you can effectively gauge what you’ll be bringing home.

3. Account for Retirement Contributions

Retirement savings are not just good practice; they can also impact your taxable income significantly. Contributions to retirement plans, like a 401(k) or an Individual Retirement Account (IRA), can help reduce your taxable income. For example, if you put away $19,500 into a 401(k), you only pay taxes on your income minus that contribution.

When you factor your retirement contributions into the net pay calculator, you can see how much you’re actually bringing home while still saving for your future. Starting early with retirement savings can boost your long-term financial security.

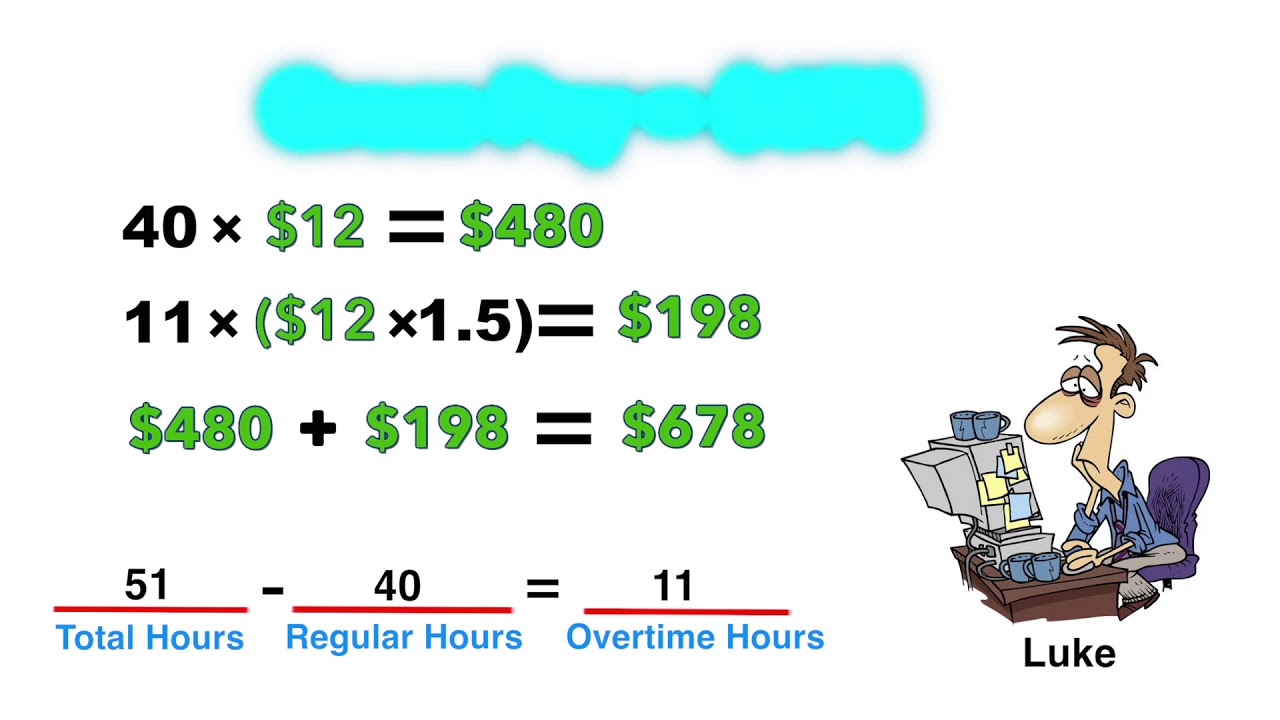

4. Factor in Additional Deductions

Additional deductions can further reduce your taxable income. Think about health insurance premiums, flexible spending accounts (FSA), or even contributions to health savings accounts (HSA). If your employer provides health coverage costing $300 per month, you’re looking at $3,600 less of your income taxable by the year’s end.

Being thorough while inputting these deductions into your net pay calculator ensures more accurate output. Explore all the voluntary benefit options available through your employer to see how they can help lower your taxable income.

5. Use the Results for Better Budgeting

A solid understanding of your net pay allows you to make smarter budgeting choices. By integrating the results from your net pay calculator with budgeting apps like Mint or You Need A Budget (YNAB), you can optimize your financial management.

Effective budgeting means knowing how much you can allocate toward savings, debt repayment, or discretionary spending. This proactive approach leads to a healthier financial state overall and can help you work toward larger goals, like homeownership or investments.

6. Combine with a Simple Loan Calculator for Holistic Financial Planning

Combining the insights from your net pay calculator with a simple loan calculator creates a comprehensive financial strategy. For example, if you’re considering financing a $200,000 home with a 4% interest rate over 30 years, a loan calculator shows your monthly mortgage payment might be around $954—before property taxes and insurance.

By weaving these insights together, you can better assess how loans may impact your financial situation long-term. Make informed choices that celebrate your financial standing instead of compromising it.

The Impact of Financial Literacy on Net Earnings

Financial literacy plays a substantial role in how effectively you can use tools like a net pay calculator. Knowing your income, deductions, and the financial instruments at your disposal empowers you to leverage your earnings.

Consider buying a home or a vehicle; understanding interest rates and total repayment amounts using a simple loan calculator illustrates how these financial decisions can affect your net earnings. An informed borrower can secure terms that fit their budget comfortably while leading to favorable financial outcomes.

Taking Charge of Your Financial Future

Mastering your net pay and taking a proactive approach with tools like a net pay calculator and a simple loan calculator can empower you significantly throughout your financial journey. By increasing your understanding of taxation, deductions, and strategy-oriented financial planning, you’re laying a solid foundation for future success.

Embracing this knowledge fosters growth and stability in your personal economy, allowing you to make educated decisions. Whether you’re a first-time homebuyer wanting guidance on first-time home buyer grants in GA or a seasoned investor looking to refinance, the financial world opens up with informed choices.

Maximize your understanding and use these tools effectively to pave your path to financial health.

Net Pay Calculator Secrets for Maximizing Your Income

Fun Trivia About the Net Pay Calculator

Did you know that the concept of a net pay calculator dates back to the early days of payroll computers? These handy tools help workers determine how much money lands in their pockets after taxes and deductions are taken out. The first calculators were as basic as they come, but boy, have they evolved! Nowadays, you can find calculators that factor in everything from state taxes to retirement contributions, making them a total game-changer for personal finance management. Speaking of other calculators, if you’re looking into car loans, check out the car loan calculator google( for an easy way to analyze your options.

When you’re using a net pay calculator, you might wonder where your hard-earned dollar is going. Most folks aren’t aware that in many states, you could miss out on first time home buyer Grants in ga( if you don’t keep track of your deductions properly. It could actually lead to significant savings when you’re ready to buy a home. Plus, being on top of your finances can help you get better deals on mortgages later on!

Here’s another fun fact: calculating your net pay is like navigating a treasure map; every piece you uncover gets you closer to that X that marks the spot! Would you believe that different hair colors can symbolize various wage levels among job hunters? Research has shown that even the traits associated with golden brown hair( might have an impact on hiring decisions! So, while you focus on maximizing your salary with a net pay calculator—well, some might say looks can matter too, even if just a little bit.

Lastly, did you know that people often overlook the importance of knowing your local housing market? For instance, if you’re living in a town like Hudson MA,( it’s essential to align your income with local rates. Whether you’re aiming to buy or simply keeping your financial health in check, using a net pay calculator regularly can shed light on your expenses and income potential, helping you plan for the future. So roll up your sleeves, use that calculator, and you may just unlock financial wisdom that will steer you in the right direction!