Understanding today mortgage rates can be daunting, especially for first-time buyers. As we dive into 2026, the mortgage landscape has shifted dramatically due to economic events, inflation, and fluctuating borrower demand. Grasping how these elements interact allows home buyers to make educated choices regarding financing options.

Understanding Today Mortgage Rates: What You Need to Know

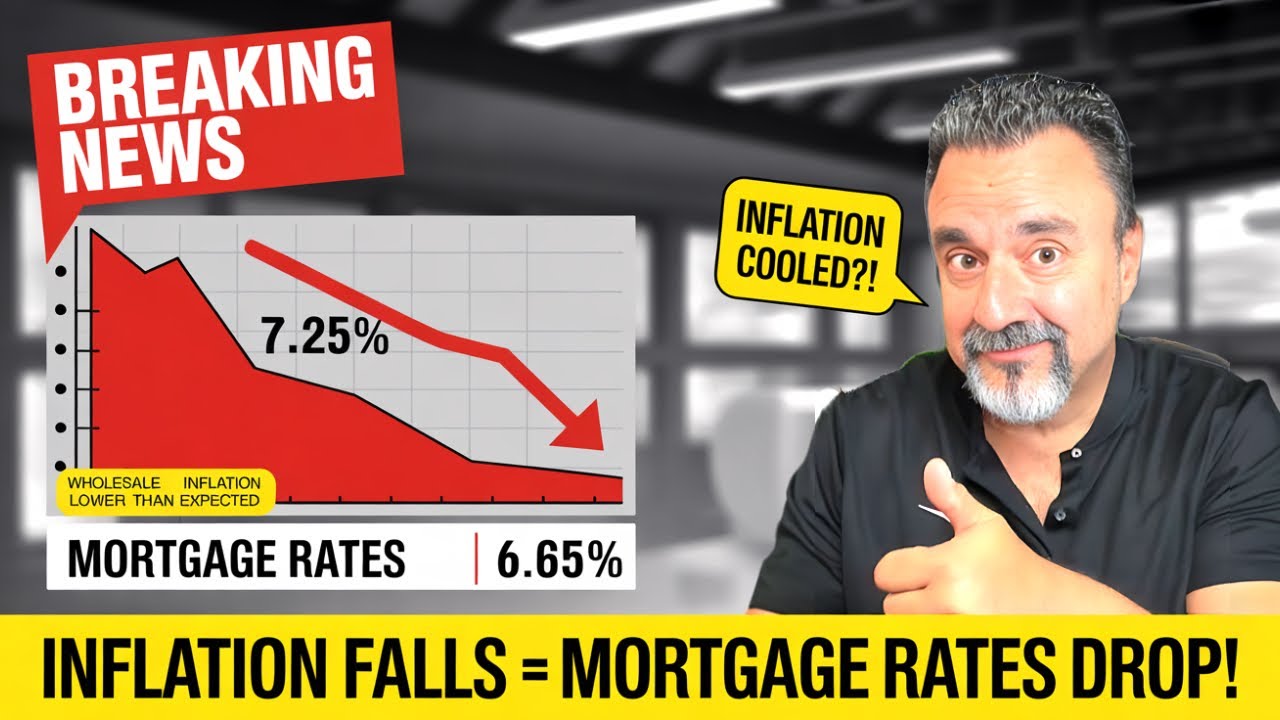

Today mortgage rates reflect not only consumer demand but also broader economic conditions. The Federal Reserve’s decisions ripple through markets, directly impacting what borrowers pay. For instance, in 2026, recent Fed rate hikes, aimed at controlling inflation, have sent ripple effects through mortgage rates, leading to surprising shifts.

It’s essential for home buyers to stay informed. Changes in regional housing markets or new lending guidelines can influence how much you pay for a mortgage. By understanding what drives today’s mortgage rates, you’ll be better equipped to navigate your options.

Tracking economic indicators, like inflation rates and employment numbers, gives insight into the potential direction of interest rates. Keeping an eye on these trends can help you know when to lock in a mortgage rate, maximizing your savings in the long run.

The Top 7 Shocking Trends in Today Mortgage Rates

Many buyers were stunned when fixed-rate mortgages jumped sharply in mid-2026. The average 30-year fixed mortgage rate soared to 5.8%, a stark contrast to the 4.2% rates just six months before. This leap is tied to a Fed rate increase designed to tackle inflation.

Though many thought rates would dive, refinancing rates have been inconsistent. Companies like Quicken Loans and Wells Fargo have experienced fluctuating numbers. Homeowners with substantial equity can find rates around 5.2%, but options vary widely across different lenders.

As fixed rates climb, countless buyers have opted for variable-rate mortgages. Lenders such as LoanDepot have noted increasing interest in 5/1 Adjustable Rate Mortgages (ARMs), which currently offer initial rates as low as 4.5%. Caution is advised, though, as these rates can rise unpredictably with market shifts.

New housing policies in 2026 introduced stricter debt-to-income (DTI) requirements. This has shocked many prospective buyers who might have qualified last year. Consequently, a few hopeful homebuyers find themselves in a waiting game, needing to boost their finances before reapplying.

Today’s mortgage rates vary significantly from region to region. For example, markets like Denver report rates averaging 6.1%, while areas in rural Texas see averages around 5.4%. It’s crucial for buyers to understand local trends and how they may impact purchasing decisions.

Compared to a year ago, first-time buyers face dwindling incentives. Programs for down payment assistance have evaporated due to budget constraints. This is concerning for eager buyers looking to enter the market without the necessary funds.

With growing consumer awareness around sustainability, lenders like Bank of America are introducing green mortgages. These loans offer competitive interest rates for energy-efficient homes, gaining traction among environmentally-conscious millennial buyers.

Analyzing Today’s Mortgage Rates: What’s Ahead?

When you evaluate today mortgage rates, consider not just the current numbers but also future trends. Many analysts suggest that the Federal Reserve’s future actions will play a pivotal role in shaping mortgage rates in the coming months. Hints of stabilization toward the latter part of 2026 could lead to slowly easing rates as the economy adjusts.

For homebuyers, locking in rates sooner rather than later could pay off. If rates trend downwards toward the end of 2026, those who hesitate may miss favorable loan options. Paying attention to economic indicators and the mortgage market can help guide your timing for securing a mortgage.

Developing a strategy rooted in up-to-date information can make all the difference. Keeping abreast of housing market shifts and mortgage trends allows buyers to seize opportunities, saving money and easing their financial burdens.

Innovative Approaches in the Mortgage Landscape

As the landscape changes, technology has come to the forefront of efficient mortgage processes. Digital platforms like Better.com are redefining traditional lending by offering competitive rates and quick processing. This tech-savvy approach helps streamline the mortgage application, making it easier for borrowers to understand their options.

Additionally, using social media insights can provide vibrant snapshots of the current market. Realtors are increasingly adopting platforms like TikTok to gauge buyer sentiment and adjust their strategies based on real-time data. This contemporary approach opens new avenues for both buyers and sellers.

Finally, leveraging these innovative resources can provide a more comprehensive perspective in today’s housing market. Staying updated can help prospective homeowners maximize their positions and cut through traditional barriers.

Crafting Your Strategy in Today’s Mortgage Landscape

In the current unpredictable mortgage world, developing a solid strategy is crucial. Whether you’re a first-time buyer or considering refinancing, understanding today mortgage rates and market dynamics can elevate your decision-making confidence. Engaging with a knowledgeable mortgage advisor can help tailor your options to your specific financial situation.

Being proactive in your financial preparations sets the stage for navigating the complexity of today’s mortgage rates. Whether it’s taking advantage of current market trends or exploring innovative financing solutions, awareness is your best ally.

Finally, remember the importance of staying informed. The mortgage landscape shifts rapidly, but with a solid understanding and robust strategy, you position yourself better to thrive—even in surprising circumstances.

By keeping your finger on the pulse of today’s mortgage rates and remaining responsive to changes, you’re not just surviving the market; you’re ready to seize the opportunities it presents to achieve your homeownership dreams.

In conclusion, understanding the various factors affecting today mortgage rates arms you with valuable insights. With solid knowledge and strategic planning, you have the power to make informed financial decisions, paving the way for successful homeownership. For more insights, explore related topics like The Biltmore estate and Stony Point.

Today Mortgage Rates: Surprising Facts and Fun Trivia

The Quirky Side of Mortgage Rates

Did you know that mortgage rates can almost feel like a rollercoaster ride? One day they’re low, and the next, they jump up higher than you’d expect! While today mortgage rates might seem daunting, they’ve actually experienced quite a ride over the years. Take, for instance, the historic low rates we witnessed in 2020 during the pandemic; it’s like we had our own housing renaissance. Imagine snagging a home loan at rates so low it made you feel like you just scored a Dyson hair tool at a steal during a flash sale!

As of today, mortgage rates draw a curious picture that can’t be ignored. Shifts often depend on economic factors, including inflation and employment rates, leading to fluctuations that catch buyers off guard. It’s wild to think that areas like San Leandro , Ca can have rates that differ drastically from other places, even states like Massachusetts where costs sometimes defy expectations. Just like how the cast of In the Heights brings a vibrant story to life, the mortgage market tells its own tale with twists and turns.

Mortgage Rates: The Shocking Truths

Sometimes, the stats around today mortgage rates can be downright shocking! For example, did you know that a mere half-point difference can significantly affect what you pay over the life of your loan? It’s like trying to avoid Nancy Spungens tumultuous lifestyle while navigating your finances! No pressure, right? And just when you think you’ve got it all figured out, a new economic report drops, sending rates soaring.

Let’s not forget that just like the scenic views at The Boathouse Christchurch, the view of current mortgage rates can change with every news headline. Borrowers often find themselves on their toes, keeping a watchful eye on the latest trends and expert tips. So, whether you’re a seasoned buyer or a first-timer, remaining savvy about today mortgage rates is crucial, helping you make informed choices that best fit your financial future.