In 2026, US mortgage rates have skyrocketed to levels that even the most experienced homebuyers find jaw-dropping. This isn’t just about monthly payments; these rates have a ripple effect throughout the housing market and influence buyer behavior on a large scale. Let’s break down the current mortgage trends and what they mean for both new and seasoned buyers alike.

Top 7 Factors Driving US Mortgage Rates in 2026

1. Federal Reserve Policies

The Federal Reserve’s hawkish stance has sent interest rates soaring. With the target rate hitting an eye-watering 5.5%, bankrate mortgage rates have also soared, creating higher borrowing costs. Homebuyers feel the crunch as things like loan origination fees and points go up as lenders adjust to the new landscape.

2. Inflation Trends

Inflation remains a significant concern. Consumer inflation reached around 6.2% in August 2026, keeping pressure on interest rates. As a result, lenders are reacting by increasing their rates, as seen in Navy Federal Credit Union mortgage rates, which have climbed significantly compared to previous years.

3. Housing Market Dynamics

The housing market is still competitive, but those escalating mortgage rates are making things tough for both buyers and sellers. FHA mortgage rates are currently hovering around 6.75%, and many first-time homebuyers are finding it harder to afford homes they were eyeing just a year ago. This trend highlights the affordability gap that’s widening in the housing market.

4. Shift in Demand

A noticeable dip in demand has occurred, driven importantly by those high mortgage rates. More potential buyers are throwing in the towel and delaying their plans to purchase. This has led to a slowdown in home sales, starkly contrasting the explosive market of the peak buying season seen in 2025.

5. Credit Score Changes

Lenders are tightening the screws on their qualifying criteria. Homebuyers are now facing stricter rules when applying for VA home loan rates or any other form of mortgage. Those with lower credit scores find the gap widening between themselves and their higher-scoring counterparts.

6. Rising Costs of Construction

The construction sector is facing rising material costs, which has led to a noticeable slowdown in new home builds. With inventory already tight, this scarcity is fueling competition in the existing home market, making it necessary to shop around as Chase mortgage rates fall in line with rising costs.

7. Long-Term Economic Activity Predictions

Looking at the horizon, analysts predict moderate economic growth but with ongoing uncertainties that influence interest rates. Predictions suggest that USAA mortgage rates may start to stabilize if inflation cools off respectfully in late 2026.

Evaluating US Mortgage Rates with Leading Lenders

1. Bankrate Mortgage Rates

Presently, Bankrate indicates that average mortgage rates hover around 7.2%, which creates a barrier to entry for many buyers eager to make a move.

2. Navy Federal Credit Union Mortgage Rates

With attractive options, Navy Federal mortgage rates currently average about 6.9% for eligible borrowers, making them an appealing choice for service members and their families.

3. VA Loan Rates

Currently, VA mortgage rates sit at around 7.0%. This means veterans and active-duty service members still have unique opportunities in a tough market but are met with the realities of high-interest conditions.

4. FHA Mortgage Rates

The FHA mortgage rates are showing some competitiveness at roughly 6.75%. This figure still appeals to many first-time buyers who can manage lower down payments.

5. USAA Mortgage Rates

For eligible members, USAA mortgage rates show an average of about 7.1%, which highlights their offerings in a tricky current mortgage climate.

6. Chase Mortgage Rates

As one of the giants in the mortgage lending industry, Chase mortgage rates are clocking in at around 7.3%. This figure can certainly make potential homebuyers rethink their timelines for making moves.

7. Comparison and Choices

When contemplating the best mortgage rates, comparing not only interest but also closing costs is essential. Understanding all lender-specific terms can help you make an informed decision that fits your financial plans.

Navigating the Future of Homebuying in a Higher Rate Environment

As we venture deeper into 2026, aspiring homebuyers must adopt a well-informed approach. The significant rise in US mortgage rates may be shocking, but it also opens doors for negotiating better terms and exploring various financing options. For investors, this could be the moment to weigh adjustable-rate mortgages or cast a wider net across lenders to find more favorable rates.

Being proactive now is critical. Monitoring market trends, staying aware of shifts in the economic landscape, and keeping an eye on competitor offerings can equip buyers with the knowledge needed to traverse this challenging market. By understanding both the macroeconomic dynamics at play as well as the specific terms lenders are offering, homebuyers can lay down a solid foundation for success in their homeownership journey.

So, whether you’re just starting your search or thinking about refinancing, stay sharp. The terrain of home loan rates is shifting, and those who stay informed stand to gain the most.

You might want to explore more about financing options or the implications of current mortgage rates on the broader market. For example, if you’re curious to know How much Is a this might impact your plans, or learn about What Is a lien, you can dive into those topics on our site for a deeper understanding.

Remember, real estate often comes down to timing and knowledge. Equip yourself well, and you’ll navigate this maze with confidence.

US Mortgage Rates: Shocking Trends and Fun Facts

The Rollercoaster of Rates

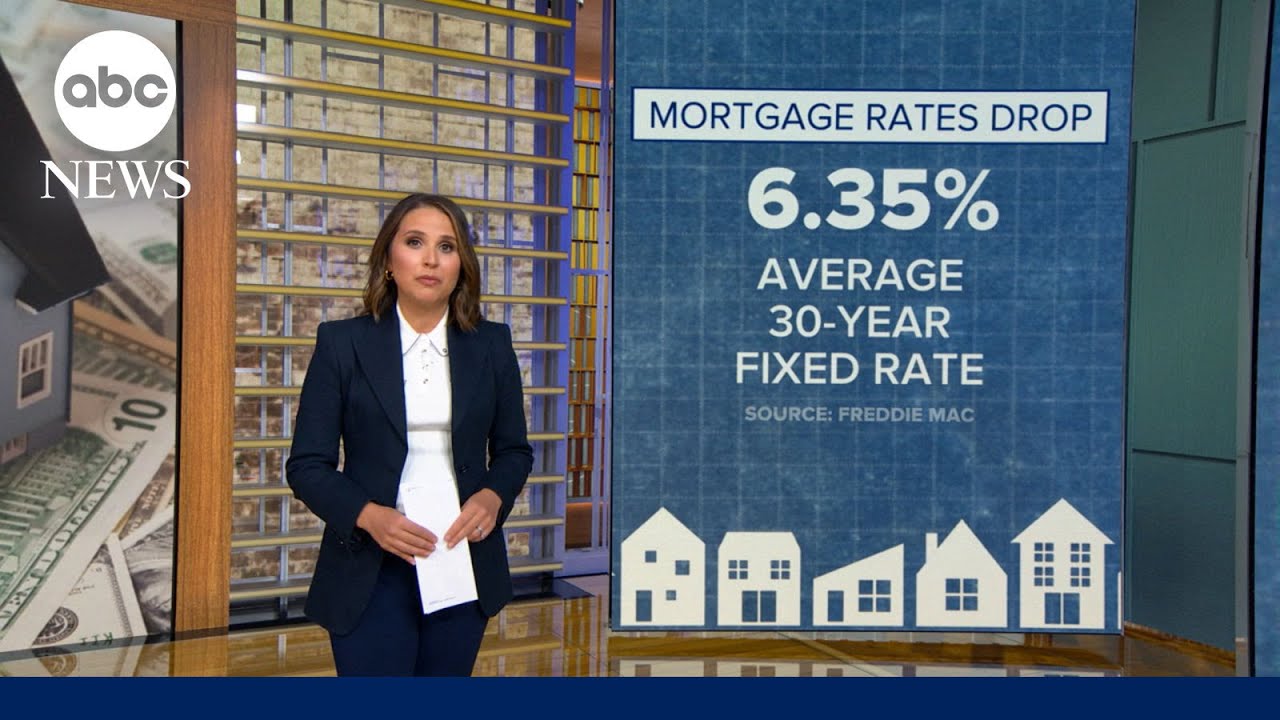

Did you know that US mortgage rates have been on a wild ride lately? Recently, the average rate for a 30-year fixed mortgage shot up to levels not seen in over a decade! A quick comparison reveals that back in 2021, rates were below 3%, making homeownership quite the sweet deal. So why the jump? Economic pressures, inflation concerns, and shifts in the Federal Reserve policies play a big role in the dance of interest rates. Speaking of market shifts, check out this lighthearted take on how people adapt in chaotic scenarios, kind of like navigating through fluctuating rates akin to a day at Zoo knoxville.

What’s Behind These Shocking Rates?

To put things in perspective, experts suggest that rising US mortgage rates often act like a double-edged sword. While higher rates can scare off some buyers, they may invite others who are eager to lock in before rates go even higher. Isn’t it interesting how consumer behavior changes with profit margins? This is somewhat akin to how shopping habits can shift during a sale, reminiscent of a trip to Shop Rite. Moreover, historical data shows that during times of uncertainty, mortgage rates have fluctuated significantly – sometimes making us wish we had a crystal ball!

Fun Facts about Home Financing

Here’s a fun tidbit for you: the highest recorded average mortgage rate was in 1981, hitting 18.5%! Yikes, right? Today’s buyers might not face those heady numbers, but they certainly feel the pinch with current rates rubbing elbows with highs seen in the 2000s – the difference being based on a robust economy. And speaking of robust influences, have you heard about how pop culture sometimes reflects financial trends? Shows like Seraph of the End capture the essence of life’s unpredictability and challenges, which could easily parallel the journeys of today’s homebuyers facing fluctuating rates. Remember to keep an eye on Bank Of America mortgage rates to help you navigate the waters!

Understanding US mortgage rates means being aware of the signs and signals in the market—much like decoding trends on social media! With borrowers searching for the best payoffs today, ensure you’re savvy, whether you’re exploring tips or just keeping tabs on what’s hot in home financing decisions, like the cool offerings at Long Wongs, which can offer delightful distractions. Whatever your approach may be, just remember: locked or floating, knowing where to look for answers (or fun trivia) can ease the homebuying journey!