When it comes to making homeownership a reality, USDA home loans stand out as an excellent option, particularly for low-to-moderate income families residing in rural and suburban areas. Backed by the U.S. Department of Agriculture, these loans not only offer favorable terms but often eliminate the need for a down payment. With such attractive benefits, understanding USDA home loans can significantly ease the pathway to owning your first home or even refinancing your existing mortgage.

Understanding USDA Home Loans

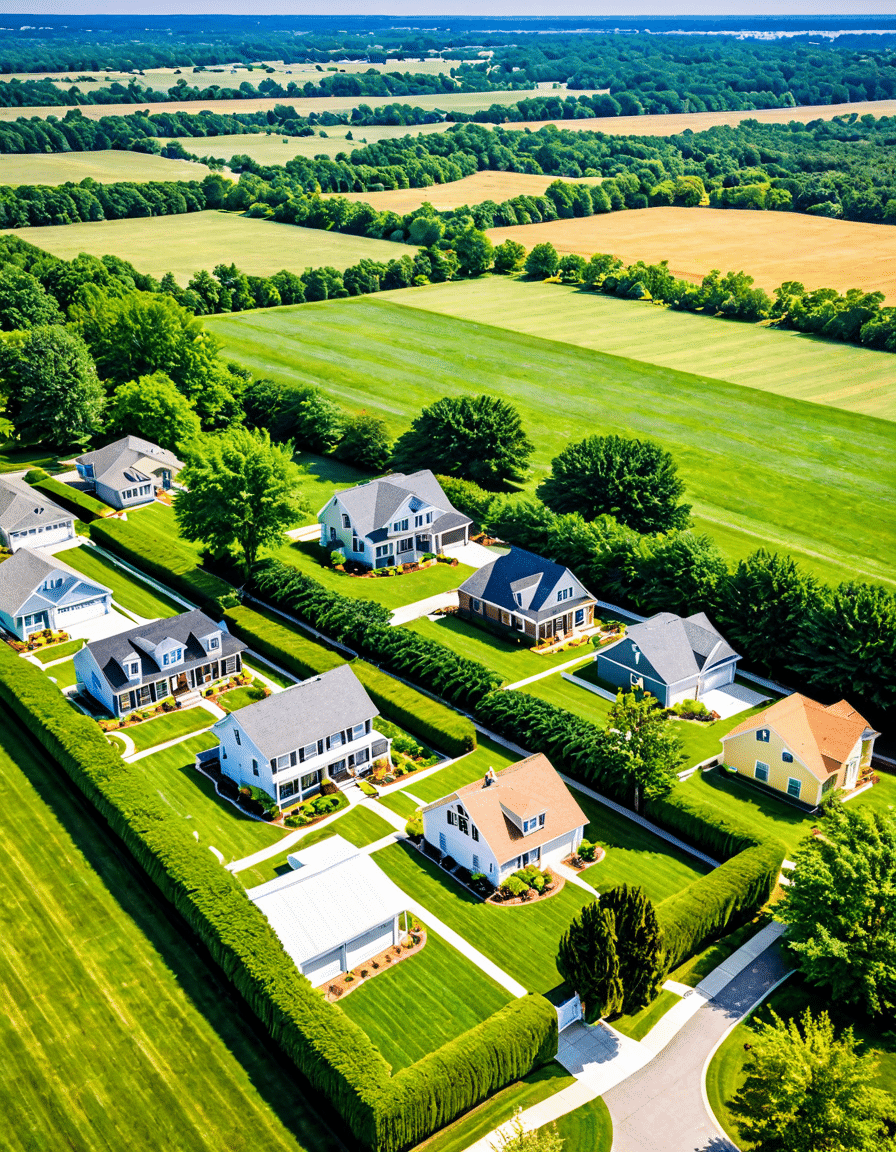

USDA home loans are tailored specifically to assist families striving for homeownership in designated rural regions. These mortgages come with unique advantages, providing a breath of fresh air to those who might feel stuck in the rental cycle. The USDA aims to help enhance the quality of life and economic well-being in rural communities by making housing more accessible.

Eligibility isn’t as stringent as one might think. It’s true that certain income caps apply, and properties must meet specific criteria, but qualifying for a USDA home loan is usually more attainable than many assume. By helping families achieve their dreams of owning a home, the USDA is fostering stronger communities across America.

Navigating the ins and outs of USDA home loans can seem overwhelming, but knowing the basics can empower potential buyers. From understanding income limits to knowing where eligible properties are located, buyers can take control of their home-buying journey with the right information.

How USDA Home Loans Work: Key Features and Benefits

1. Zero Down Payment Requirement

One of the most attractive features of USDA home loans is the zero down payment option. Unlike conventional loans that typically require a 20% down payment, USDA loans allow you to buy a home without any upfront cash. This helps first-time buyers keep more money in their pockets for potential home improvements or unexpected expenses—just like how a savvy buyer might take advantage of an Amazon sale to save on new appliances!

2. Competitive Interest Rates

USDA home loans often come with lower interest rates compared to conventional loans. Many mortgage lenders, such as Wells Fargo and Quicken Loans, offer rates that might help you save thousands over the life of a loan. These savings can make monthly payments significantly more manageable, allowing homeowners to focus on their new investment.

3. Flexible Credit Requirements

Traditional lenders usually want a minimum credit score of at least 620. USDA loans, however, can accommodate borrowers with credit scores as low as 580. This flexibility has been a game-changer for many, letting buyers secure financing even while they work on improving their financial fitness—kind of like a dedicated athlete pushing for more, showcasing a wrestling attitude in their efforts!

4. No Private Mortgage Insurance (PMI)

One often-overlooked aspect of USDA home loans is that they don’t require mortgage loan insurance (PMI). Instead, these loans may come with an upfront guarantee fee and an annual fee, but both fees are typically lower than PMI over time. This means that homeowners can enjoy even lower monthly payments, freeing up cash for other essential needs.

5. Eligible Properties

To qualify for a USDA loan, homes must be situated in USDA-designated rural areas and must be the borrower’s main residence. This criterion not only opens doors to affordable housing options but supports growth in less crowded areas. For instance, buyers looking at homes near the serene Ocala National forest can find some hidden gems, given that many of these properties are highly competitive compared to urban markets.

6. Income Limits

Families hoping to qualify for USDA home loans must earn within specific income thresholds. These limits can differ based on location, often stretching up to 115% of the median income for a given area. This inclusivity effectively brings more families into the housing market, much like a festival atmosphere inviting everyone to join.

Finding the Best Mortgage Lenders for USDA Home Loans

It’s vital to choose the right mortgage lender when pursuing a USDA home loan. Here are some of the best mortgage lenders to consider:

Additionally, connecting with a capable mortgage loan officer can ease your journey toward homeownership. They can clarify eligibility requirements and streamline the application process for you. Remember, their expertise can make a significant difference in your experience.

Working with a Mortgage Loan Officer

Selecting a knowledgeable mortgage loan officer is crucial, especially in grasping the specifics of USDA home loans. These professionals can help you understand your eligibility, assist with the necessary paperwork, and ensure all your financial documentation aligns with lender expectations.

A solid mortgage loan officer also navigates the intricate loan landscape on your behalf. They can present options and advice that reflect your unique financial goals, acting as your guide in the home-buying adventure.

Real-Life Success Stories

Consider Sarah and Tom from rural Iowa, who turned their dreams into reality by purchasing their first home without a down payment, courtesy of USDA home loans. Their mortgage loan officer helped them understand eligibility criteria and guided them through the sometimes-challenging application process.

Then there’s John, a first-time buyer in South Carolina, who used a USDA loan to buy a charming fixer-upper in an eligible area. With lower interest rates and no PMI, John felt confident that this new home was an excellent financial decision for his growing family—kind of like planting roots at the Bellagio Conservatory.

Success stories like these show the real impact USDA home loans can have on people’s lives. They open doors to opportunities for family stability and investing in community growth.

The Future of USDA Home Loans

As the quest for affordable housing continues, USDA home loans remain a pivotal resource for potential buyers, especially those in rural locations. The USDA is dedicated to providing accessible lending solutions, including discussions about expanding income limits and property eligibility areas.

These changes could enable even more families to step into homeownership, reinforcing the foundations of our communities. By creating stability through owning homes, USDA loans help nurture neighborhood ties, instilling a sense of belonging much like Catherine Zeta jones would feel representing her roots through inspiring stories.

In essence, for families looking to transition from renting to owning, exploring the multifaceted qualities of USDA home loans can lead to unlocking new opportunities. Just as every community breathes life into itself, so too can each family find meaning through homeownership.

By teaming up with reputable mortgage lenders and working closely with skilled mortgage loan officers, families can map out the path to homeownership with confidence. Whether it’s farmlands, cozy cottages, or suburban residences—USDA home loans are paving the way, one homestead at a time.

USDA Home Loans: Accessibility and Fun Facts

A Brief Overview of USDA Home Loans

Did you know that USDA home loans are specifically crafted to help low-to-moderate income families achieve their dream of homeownership? These loans are backed by the United States Department of Agriculture, and they don’t require a down payment, making it easier for many folks to step into their new homes. If you’re thinking about all the possibilities once you’ve moved in, just picture yourself relaxing at the Lewis Ginter Botanical Garden. It’s a fantastic way to unwind and enjoy nature, right in the heart of Richmond, Virginia!

Fun Trivia to Brighten Your Day

Now, here’s something interesting: the eligibility for USDA home loans isn’t just about your income; it also depends on where you live. Properties located in designated rural areas qualify, and this can open up some unexpected and beautiful neighborhoods. Imagine your future home near Universal City—it’s amazing how many charming communities exist just outside urban environments! The perks of these loan options include fixed interest rates which can save money over the life of the loan, allowing you to invest in experiences like a night out enjoying the latest film like Satyaprem Ki Katha.

The Impact and Recognition of USDA Loans

This brings us to how USDA loans have made a real impact. According to the latest reports, these loans have helped millions become homeowners. In fact, many success stories come from families who thought owning a home was out of reach. The loans streamline the process significantly, almost like how Douglas Fregin streamlined innovations in his field! So, if you’re looking to settle down and become part of a wonderful community, USDA loans might be your ticket to success! With the right information and approach, homeownership is not just a dream; it’s a highly achievable goal.